- The era of easy money is over, with capital scarcity and soaring debt reshaping the way markets operate.

- Louis Gave warns that fiscal dominance, fragile safety nets, and shifting geopolitics demand a new playbook for investors.

- Emerging markets like India and Mexico could be the surprise winners in this new global order.

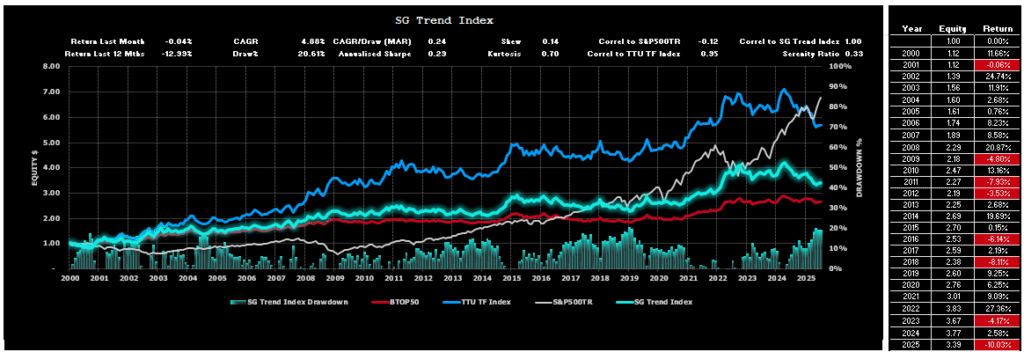

For forty years, investing had a simple rhythm. Each downturn was met with lower interest rates, more liquidity, and a renewed confidence that central banks could smooth the ride. Investors learned that patience was rewarded and that declines were temporary, but that rhythm might be breaking.

We’re moving into a world where capital is scarce, deficits matter, and governments are competing with one another for money. Louis-Vincent Gave, Founding Partner & CEO at Gavekal, calls this the age of fiscal dominance, when the weight of public debt dictates what central banks can and cannot do. It sounds like a policy debate, but it’s much more significant because it alters the foundation of how markets operate and how portfolios must be constructed.

The world of abundance is fading, and the world of scarcity is emerging. That transition is showing up in ways that are already reshaping the economy.

A Fiscal Delusion About to Snap

The United States is living through what feels like a free party. Government borrowing has soared, and for a time, it seemed painless. Like tequila shots, it feels good until it doesn’t. Trillions of dollars in new debt were absorbed because investors assumed the old rules applied: the Fed would keep yields low, the dollar would stay strong, and buyers would always show up.

But the math is harder now. Debt is rising faster than growth, and interest costs are eating a larger share of tax revenue. Fiscal dominance means that the market, rather than the Fed, will set the price of money. When the bond market decides it needs a higher yield, there may be no easy escape route. The moment the delusion snaps, it will not be a slow adjustment. It will be sudden and jarring, like waking up the morning after the party.

Tariffs Quietly Squeezing the Job Engine

Inflation and interest rates dominate headlines, but another force is gnawing at the U.S. economy. Tariffs and trade restrictions are quietly freezing the construction sector. Construction is more than buildings and bridges. It’s one of the most labor-intensive parts of the economy, employing millions of workers across trades.

When projects stall because steel or parts cost more, it has ripple effects. Jobs freeze, small businesses delay expansion, and uncertainty spreads. Policy designed to protect industries is quietly suffocating the very job engine the economy relies on. It’s not yet obvious in the data, but markets often turn before the numbers catch up.

All the Lights Are Green, Yet the Engine Is Cracking

By traditional measures, the economy should be roaring. Capital is still relatively cheap compared to historical levels, energy prices are contained, and deficits are large enough to stimulate demand. Almost every light on the dashboard is green.

Yet the engine might be sputtering: Productivity growth is weak, small businesses report stress, and many households feel squeezed. Louis Gave argues that the old models are broken because they assume policy follows logic. Today, policy follows politics, and markets, trained to expect one kind of response, may find themselves in a different game altogether.

The AI Boom and the Risk of a Historic Bust

The last two years have added roughly $6 trillion in market value to companies tied to artificial intelligence and cryptocurrency. Nvidia, the emblem of AI’s promise, became one of the most valuable companies in history. Investors piled in with the confidence of people who believe this technology will reshape the world.

It may. However, if reality lags behind the narrative, history offers a guide. The dot-com bubble was not wrong about the internet. It was wrong about timing and profitability. If AI disappoints on either front, the correction will not just dent a few companies. It could erase years of gains and echo the pain of 2008, this time focused on the most hyped sector of our era.

The Dollar’s Last Safety Net

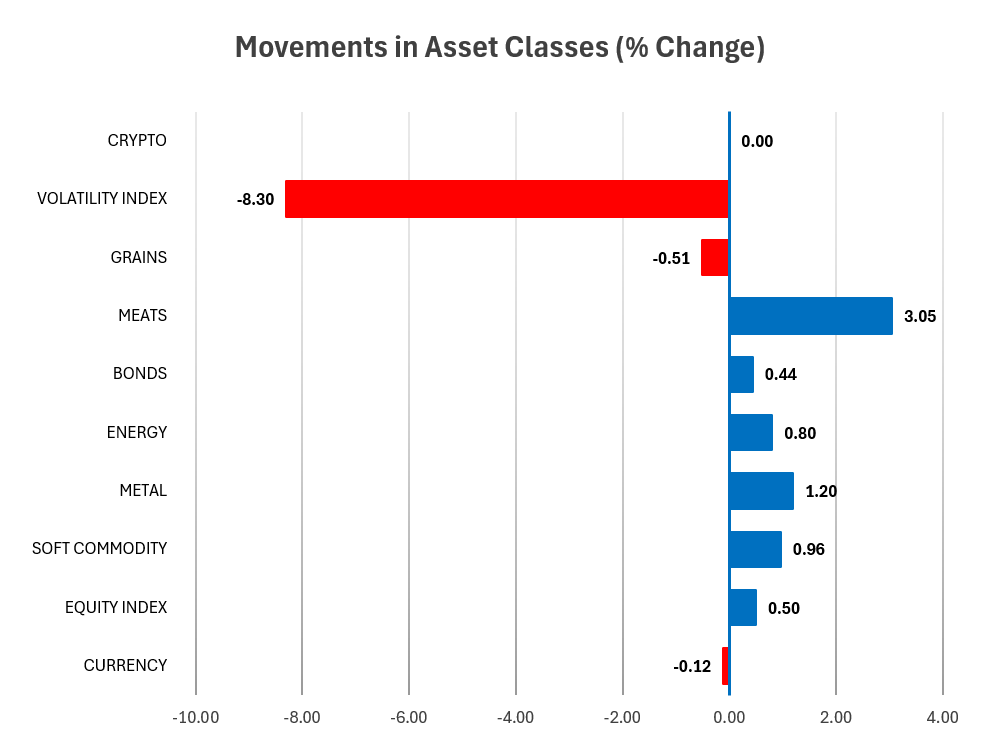

April 2025 produced a shock that went largely unnoticed. U.S. stocks, bonds, and the dollar all declined simultaneously. For decades, investors relied on the idea that when one struggled, the others would provide cover. That correlation shattered.

Louis Gave says this is what an emerging market crisis looks like. In emerging markets, when investors lose confidence, everything tends to sell off together. The world has just witnessed this dynamic in the U.S., the issuer of the world's reserve currency. If the safety net of diversification fails, investors must rethink not only portfolios, but assumptions about stability itself.

China’s Strategic Reordering of Power

It’s easy for the West to describe China as slowing: Growth rates are lower than in past decades, and domestic property markets remain fragile. Yet beneath the headlines, China is pursuing a deliberate strategy.

It’s exporting aggressively to the emerging world. It’s providing cars, batteries, and infrastructure at prices competitors struggle to match. It’s financing much of this through Hong Kong, reducing reliance on the U.S. dollar. The narrative of a weak China misses the point. China is redefining the map of global power and creating new dependencies across Asia, Africa, and Latin America. The long-term investment consequences of that shift are just beginning.

The Next Spark for Inflation

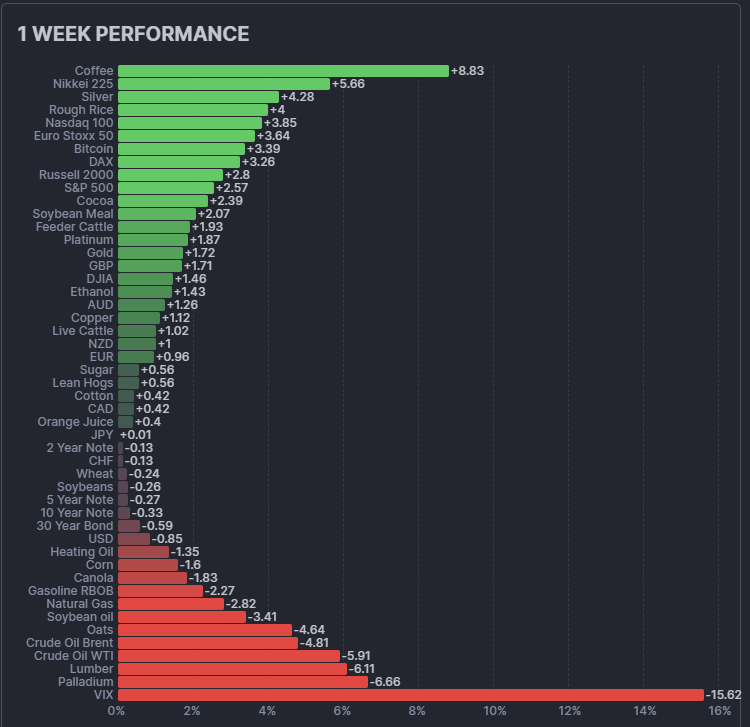

Energy prices today look tame. Oil trades within a comfortable range. Gasoline is not spiking at the pump. Investors have relaxed.

But the underlying picture is fragile. A decade of underinvestment in supply has resulted in tight production capacity. Meanwhile, demand from the global south is rising as billions of people improve their living standards. If oil surges because demand outpaces supply, inflation will not just return. It could come back with force, testing central banks and portfolios alike.

Emerging Markets Return to the Stage

Amid capital scarcity, not all regions are equal. Countries with credible fiscal policy, demographic strength, and improving productivity can attract capital and grow. Those without will struggle.

Louis Gave sees emerging markets as the overlooked winners. India and Mexico stand out. Both benefit from younger populations, favorable geography, and supply chains that are shifting away from China. For decades, investors treated developed markets as the safe core and emerging markets as the risky satellite. That assumption may invert. The trade of the decade could be in places investors have long underweighted.

What This Means for Portfolios

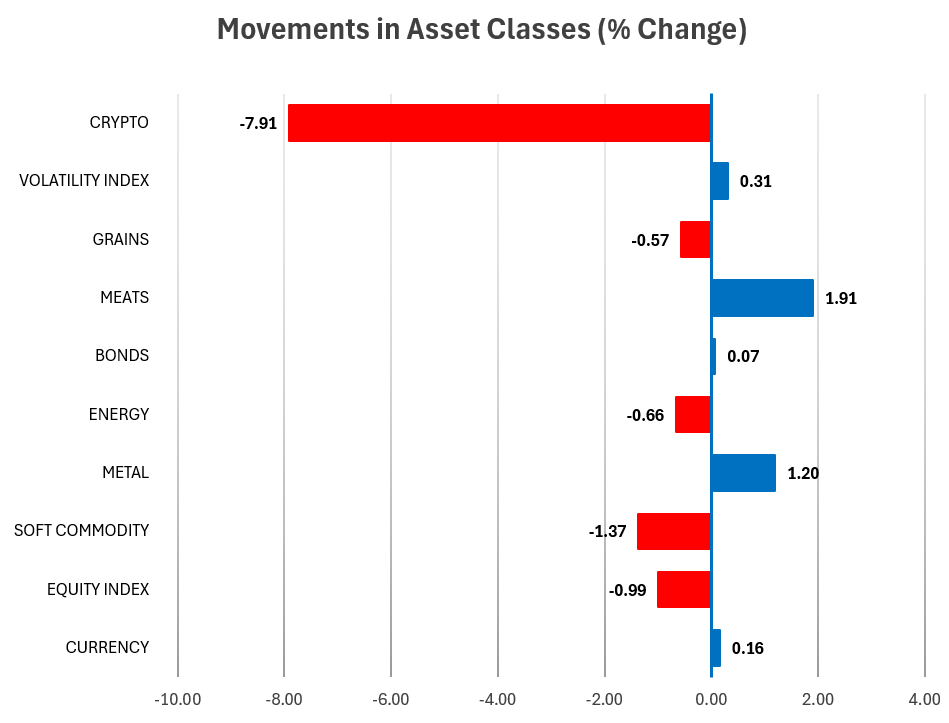

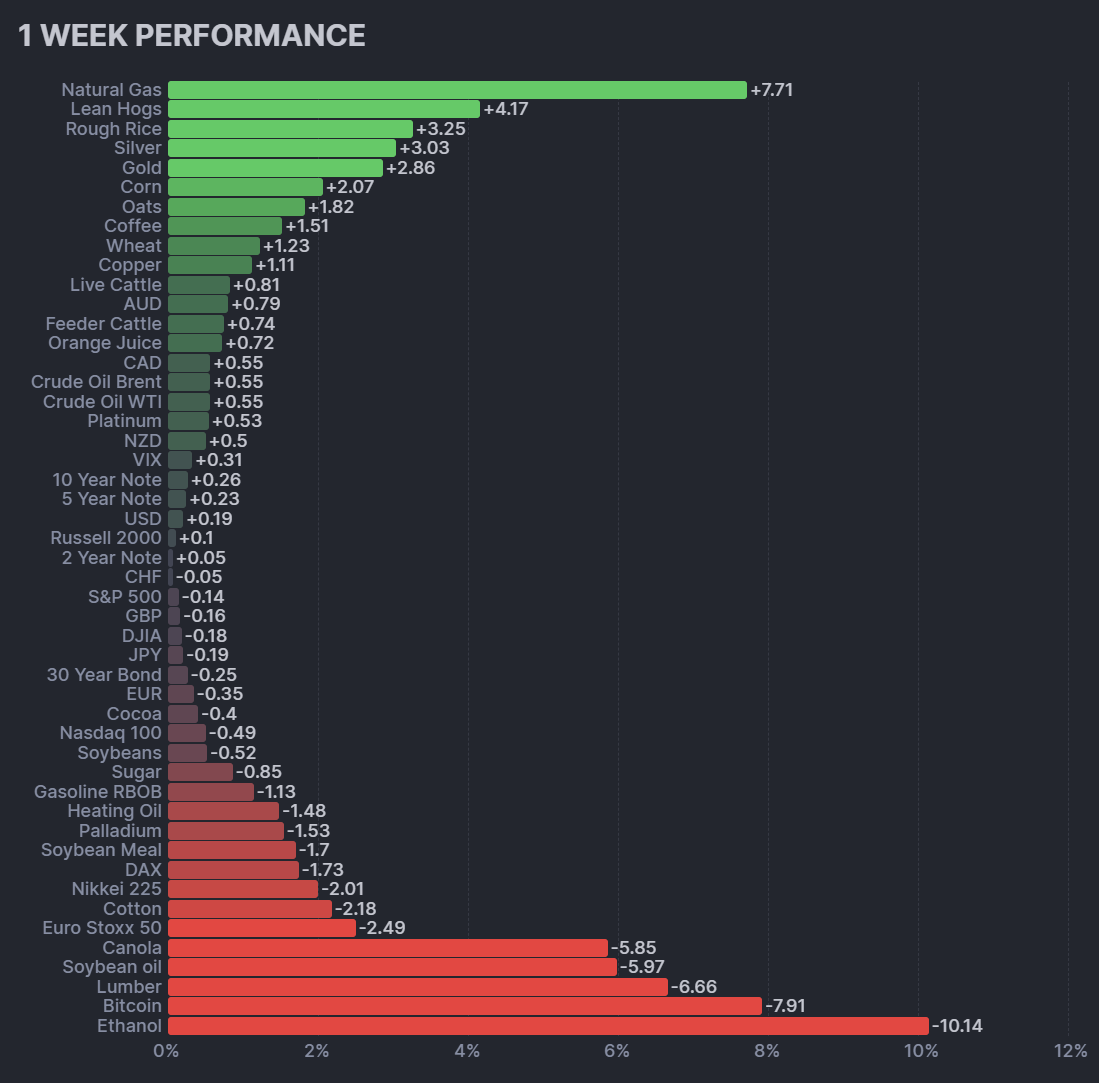

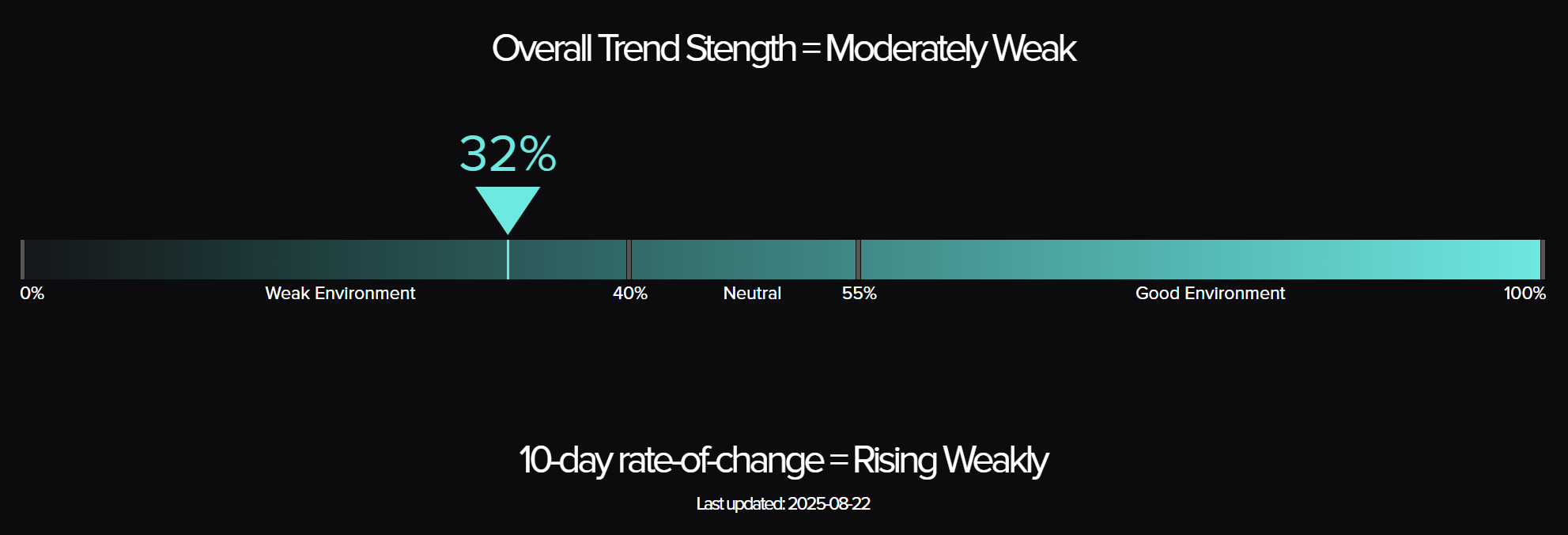

The list of shocks is not just a collection of scary headlines. Each one is a symptom of a deeper shift: from a world of abundant capital to a world where capital is scarce and governments must compete for it.

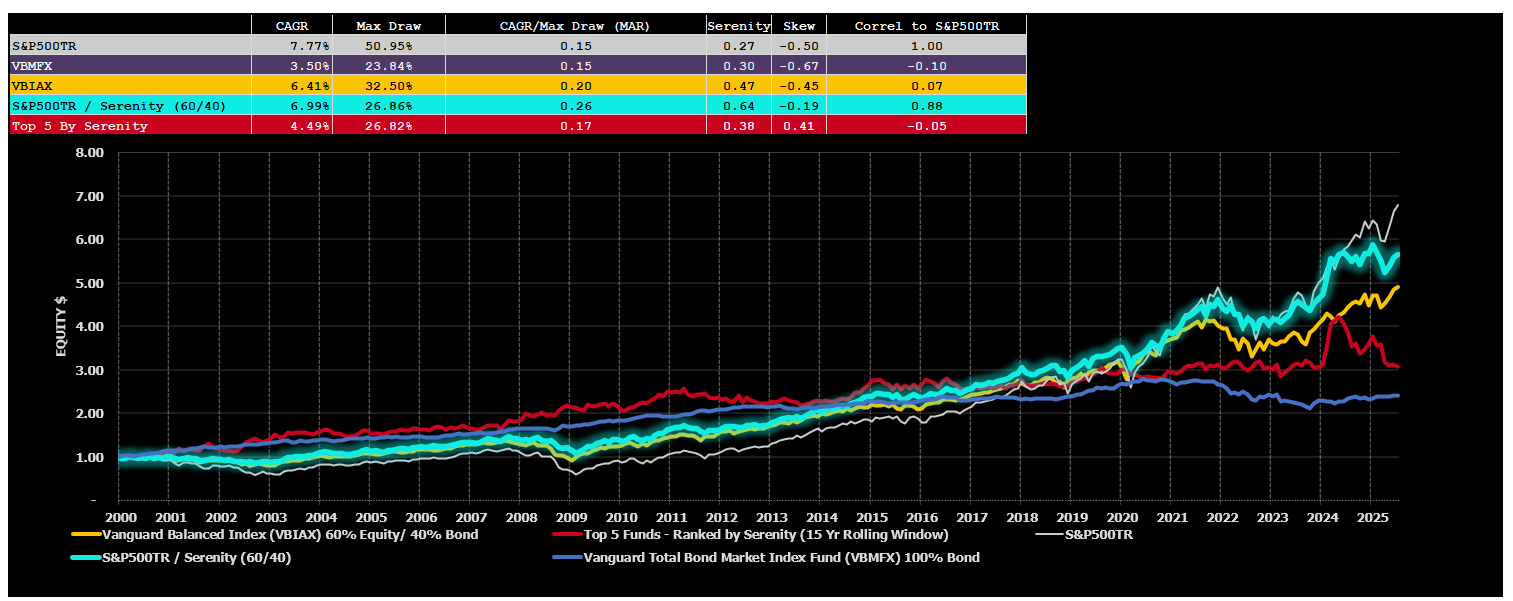

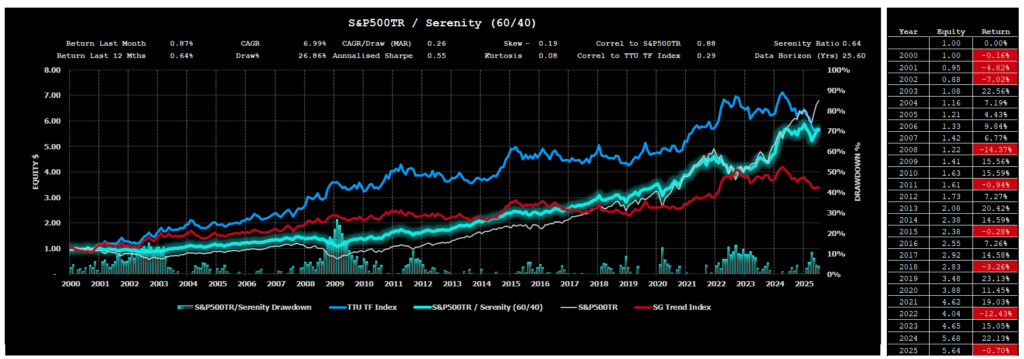

In that environment, portfolios built for the last forty years are misaligned. Bonds are no longer a one-way bet. Real assets tied to scarcity, like commodities and infrastructure, take on new appeal. Equities that rely on leverage may falter, while those with strong balance sheets and self-funding ability stand out. Diversification can no longer assume that developed markets all share the same risk profile. Emerging markets may offer not just growth, but resilience.

The Need to Think Differently

The hardest part of investing in a new regime is not the math. It is the mindset. For decades, investors were trained to believe that the Fed would save them. Rate cuts were the Pavlovian response to weakness. That habit is deeply ingrained.

However, if fiscal dominance means central banks are constrained, waiting for the old playbook is costly. Like a family that has always refinanced its mortgage at three percent, it is tempting to assume relief will come. If the renewal notice arrives at six percent and stays there, the habit itself becomes the risk.

Howard Marks has written that the biggest risks are often the ones investors dismiss because they feel unfamiliar. Morgan Housel reminds us that behavior, not analysis, often drives results. Put those together, and the lesson is clear: the unfamiliarity of fiscal dominance is exactly why it is dangerous.

The last era’s core truth was that interest rates would fall. The core truth of this era may be that capital is scarce, and governments compete for it just like companies do. Recognizing that shift is not about fear. It is about adaptation.

For investors willing to see the change, the next generation of returns will not come from clinging to the past, but from embracing the discipline of scarcity.

This is based on an episode of Top Traders Unplugged, a bi-weekly podcast with the most interesting and experienced investors, economists, traders and thought leaders in the world. Sign up for our Newsletter or subscribe on your preferred podcast platform so that you don't miss out on future episodes.