Trend Following - Week in Review - August 29 , 2025

“Fragile Floor, Outliers Fade”

This Week in Trend – 29 August 2025

Welcome back to This Week in Trend, your weekly pulse check on global futures and the state of systematic trend following.

The TTU Trend Barometer eased to 30 percent, down from last week’s 32, leaving conditions firmly in “very weak” territory. Breadth remains thin. A few markets delivered strong moves—natural gas, hogs, and precious metals—but broader participation faded. Crypto, softs, and equities weighed heavily, reminding us that dispersion cuts both ways.

SG Trend Index Performance

- Month-to-date (as of Aug 29): +2.89%

- Year-to-date: -7.43%

(Previous week: +1.74% MTD | -8.46% YTD)

August closed in positive territory, lifted by energy, metals, and livestock trends. Still, the YTD drawdown remains steep, reflecting how isolated outliers cannot offset weakness across the broader complex.

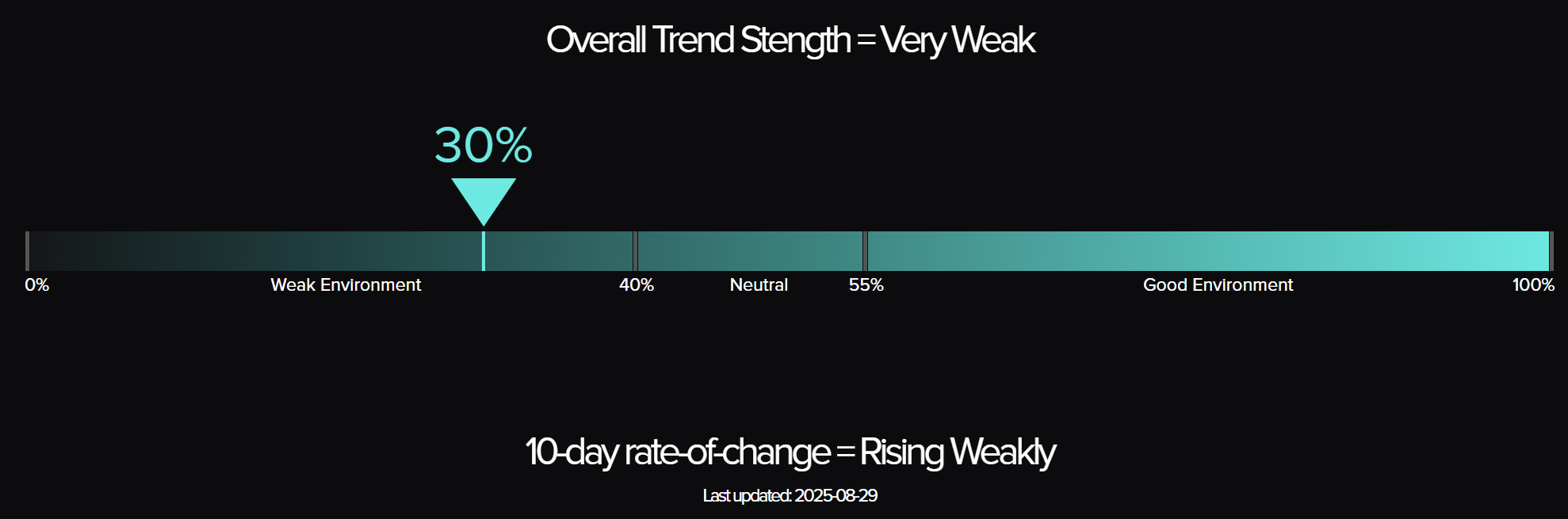

TTU Trend Barometer

- Current reading: 30 percent – Very Weak

- Previous reading: 32 percent

- 10-day rate of change: Rising weakly

At just 30 percent, fewer than a third of markets show medium-to-strong trend strength. The floor is fragile.

“At thirty, the floor is fragile—and the roar of outliers has faded into scattered whispers.”

The Top Traders Unplugged (TTU) Trend Barometer is a proprietary tool that measures the percentage of markets with medium to strong trends. Similar to a thermometer, where 0 degrees Celsius equates to freezing, a TTU Trend Barometer reading below 40% indicates a “cold” environment for trend-following, while readings above 55% signal a “hotter,” more favourable trend environment.

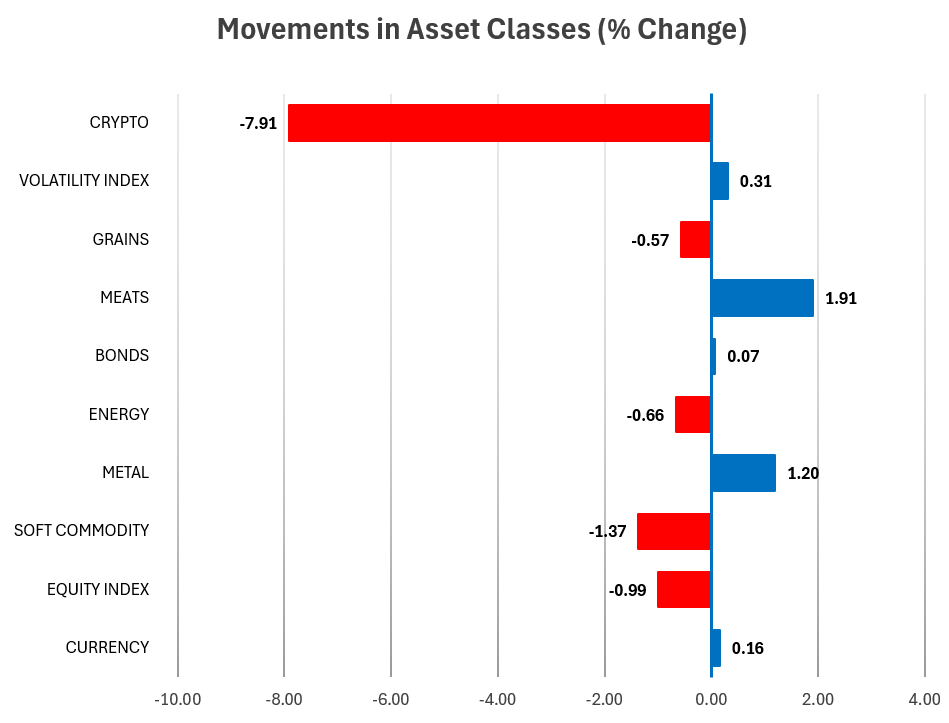

Weekly Asset Class Snapshot

Source: Finwiz.com

Asset Class Breakdown – Reversals and Continuations

- Meats: +1.91% – Cattle and hogs extended clean upward trends.

- Metals: +1.20% – Silver and gold surged; copper steadied.

- Bonds: +0.07% – Flat to positive, steady diversification.

- Currencies: +0.16% – Majors quiet, USD rangebound.

- Volatility Index: +0.31% – VIX edged higher, reversing last week’s crush.

- Grains: -0.57% – Corn, wheat, and oats gained, soybeans mixed, canola weak.

- Energy: -0.66% – Nat gas rallied, but crude products dragged.

- Soft Commodities: -1.37% – Cocoa, cotton, lumber, and sugar fell; coffee gained modestly.

- Equities: -0.99% – US indices softened, with Nasdaq and Nikkei hardest hit.

- Crypto: -7.91% – Bitcoin collapse drove the week’s biggest losses.

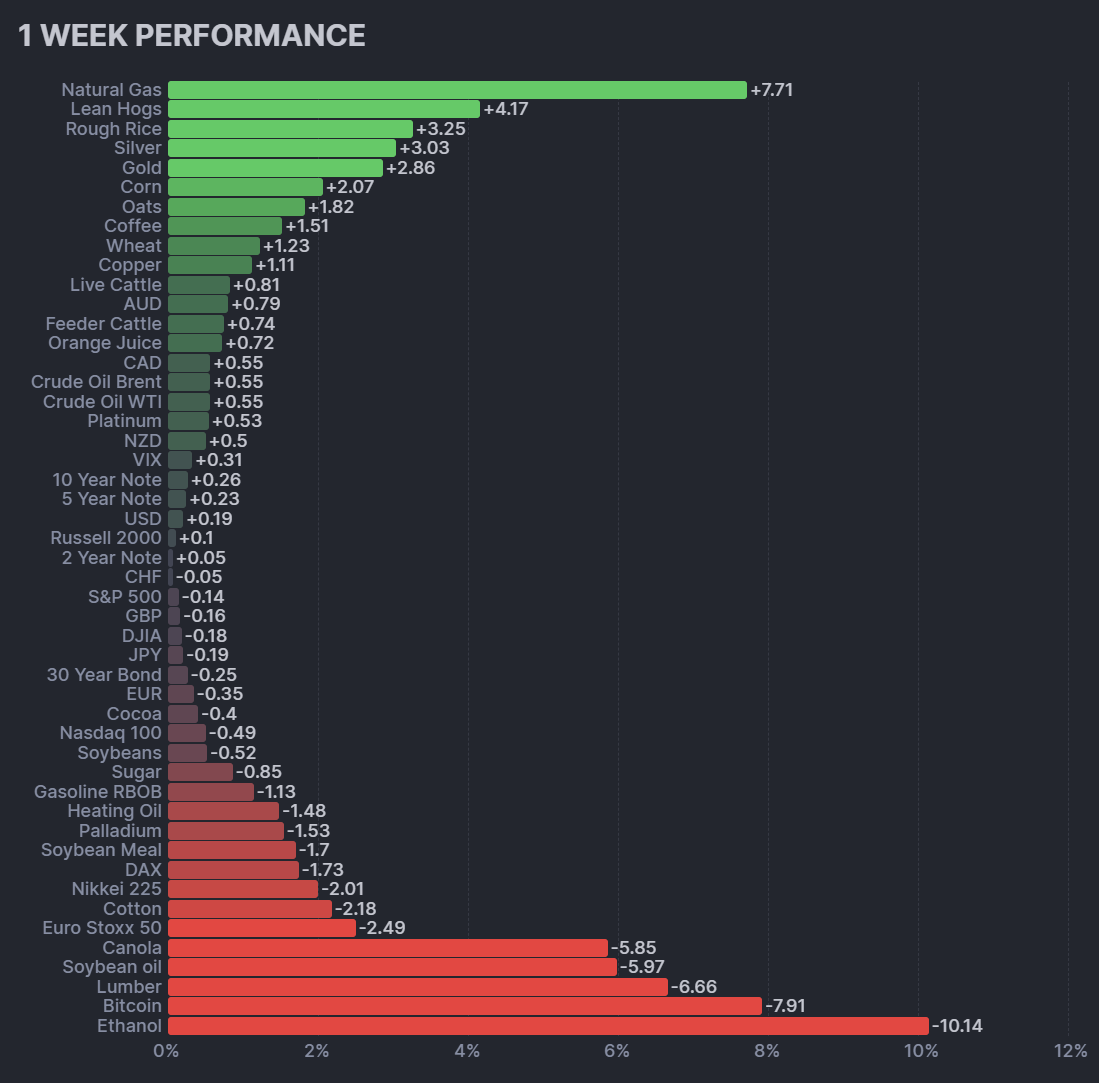

Performance Highlights – This Week’s Market Leaders & Laggards

Top Market Movers

Top Gainers

- Natural Gas: +7.71% – Explosive rebound from deep lows.

- Lean Hogs: +4.17% – Meats complex extended gains.

- Rough Rice: +3.25% – Bounced sharply after prior week’s collapse.

- Silver: +3.03% – Precious metals strength broadened.

- Gold: +2.86% – Another week of steady buying.

Top Losers

- Ethanol: -10.14% – Steep collapse capped the energy complex.

- Bitcoin: -7.91% – Heavy downside break in crypto.

- Lumber: -6.66% – Continued structural weakness.

- Soybean Oil: -5.97% – Oils complex under pressure.

- Canola: -5.85% – Agricultural weakness widened.

Portfolio View - Positioning and Impact

- Energy: Nat gas longs dominated, crude steady, but products and ethanol dragged.

- Metals: Gold and silver strong; palladium lagged.

- Grains: Corn and wheat gains offset soy oils weakness.

- Softs: Coffee firmed, but cocoa, lumber, cotton, and sugar dragged.

- Meats: Long cattle and hogs remain portfolio leaders.

- Bonds: Provided modest, stable diversification.

- Equities: Global indices softened, led by Nasdaq (-1.3%) and Nikkei (-1.9%).

- Currencies: Quiet week, no conviction shifts.

- Crypto: Bitcoin losses offset commodity strength.

- Volatility: VIX ticked higher, easing pressure on breakouts.

Final Reflections – Fragile Floor, Outliers Fade

This week was a quieter study in fragility. Last week’s roar of coffee and cattle gave way to muted outliers. Natural gas and metals offered strength, but crypto, softs, and equities dragged portfolios back. With the TTU Barometer at 30 percent, breadth remains absent.

For trend followers, the lesson is timeless: robust portfolios cannot rely on breadth in weak environments—they survive by catching the rare outliers that persist, even when the floor beneath remains fragile.

List of Resources used in the Week in Review

Important Disclaimers

This document is directly solely to Accredited Investors, Qualified Eligible Participants, Qualified Clients and Qualified Purchasers. No investment decision should be made until prospective investors have read the detailed information in the fund offering documents of any manager mentioned in this document. This document is furnished on a confidential basis only for the use of the recipient and only for discussion purposes and is subject to amendment This document is neither advice nor a recommendation to enter into any transaction. This document is not an offer to buy or sell, nor a solicitation of an offer to buy or sell, any security or other financial instrument. This presentation is based on information obtained from sources that TopTradersUnplugged (“TTU”) (“considers to be reliable however, TTU makes no representation as to, and accepts no responsibility or liability for, the accuracy or completeness of the information. TTU has not independently verified third party manager or benchmark information, does not represent it as accurate, true or complete, makes no warranty, express or implied regarding it and shall not be liable for any losses, damages, costs or expenses relating to its adequacy, accuracy, truth, completeness or use.

All projections, valuations, and statistical analyses are provided to assist the recipient in the evaluation of the matters described herein. Such projections, valuations and analyses may be based on subjective assessments and assumptions and may use one among many alternative methodologies that produce different results accordingly, such projections, valuations and statistical analyses should not be viewed as facts and should not be relied upon as an accurate prediction of future events. There is no guarantee that any targeted performance will be achieved Commodity trading involves substantial risk of loss and may not be suitable for everyone

TTU is not and does not purport to be an advisor as to legal, taxation, accounting, financial or regulatory matters in any jurisdiction. The recipient should independently evaluate and judge the matters referred to herein. TTU does not provide advice or recommendations regarding an investor’s decision to allocate to funds or accounts managed by any manager (“or to maintain or sell investments in funds or accounts managed by any manager, and no fiduciary relationship under ERISA is created by the investor investing in funds or accounts managed by any manager, or through any communication between TTU and the investor

In reviewing this document, it should be understood that the past performance results of any asset class, or any investment or trading program set forth herein, are not necessarily indicative of any future results that may be achieved in connection with any transaction. Any persons subscribing for an investment must be able to bear the risks involved and must meet the suitability requirements relating to such investment. Some or all alternative investment programs discussed herein may not be suitable for certain investors This document is directed only to persons having professional experience in matters relating to investments. Any investment or investment activity to which this document relates is available only to such investment professionals. Persons who do not have professional experience in matters relating to investments should not rely upon this document.

This document and its contents are proprietary information of TTU and may not be reproduced or otherwise disseminated in whole or in part without TTU’s prior written consent.

This document contains simulated or hypothetical performance results that have certain inherent limitations AND SHOULD BE VIEWED FOR ILLUSTRATIVE PURPOSES. Unlike the results shown in an actual performance record, these results do not represent actual trading. HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR INVESTMENT ACCOUNT.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM OR OTHER ASSET.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. No representation is being made that any investment will or is likely to achieve profits or losses similar to those being shown.

Most Comprehensive Guide to the Best Investment Books of All Time

Most Comprehensive Guide to the Best Investment Books of All Time

Get the most comprehensive guide to over 600 of the BEST investment books, with insights, and learn from some of the wisest and most accomplished investors in the world. A collection of MUST READ books carefully selected for you. Get it now absolutely FREE!

Get Your FREE Guide HERE!