Trend Following - Week in Review - September 19, 2025

“Narrow Resilience, Heavy Setbacks”

This Week in Trend – 19 September 2025

Welcome back to This Week in Trend, your weekly pulse check on global futures and the state of systematic trend following.

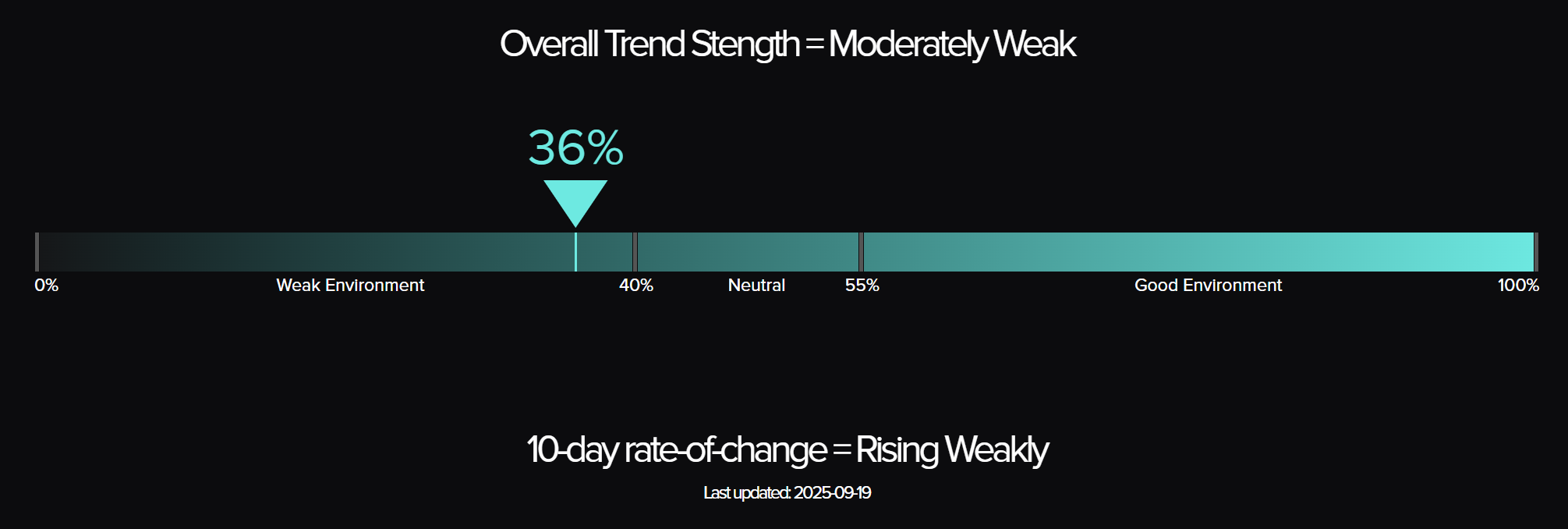

The TTU Trend Barometer slipped to 36 percent from 45 percent last week, moving conditions from neutral back into moderately weak territory. Breadth narrowed with fewer markets participating. The SG Trend Index still advanced, rising to +3.36% month-to-date and cutting YTD losses to −4.55% (versus +2.55% MTD and −5.30% YTD last week). Equities and meats carried the torch, while sharp reversals in coffee and palladium reminded traders how fragile progress remains.

SG Trend Index Performance

- Month-to-date (as of Sep 19): +3.36%

- Year-to-date: -4.55%

(Previous week: +2.55% MTD | -5.30% YTD)

The SG Trend Index extended its month-to-date recovery, though progress slowed as breadth faltered. Equities and meats delivered upside while commodities like coffee and palladium collapsed, trimming momentum.

TTU Trend Barometer

- Current reading: 36 percent – Moderately Weak

- Previous reading: 45 percent

- 10-day rate of change: Rising moderately

The barometer dipped back below neutral, underscoring that resilience remains narrow. Heavy commodity setbacks outweighed equity gains.

“Fragile breadth defines this week — resilience in a few beams, but heavy weights keep the structure unsteady.”

The Top Traders Unplugged (TTU) Trend Barometer is a proprietary tool that measures the percentage of markets with medium to strong trends. Similar to a thermometer, where 0 degrees Celsius equates to freezing, a TTU Trend Barometer reading below 40% indicates a “cold” environment for trend-following, while readings above 55% signal a “hotter,” more favourable trend environment.

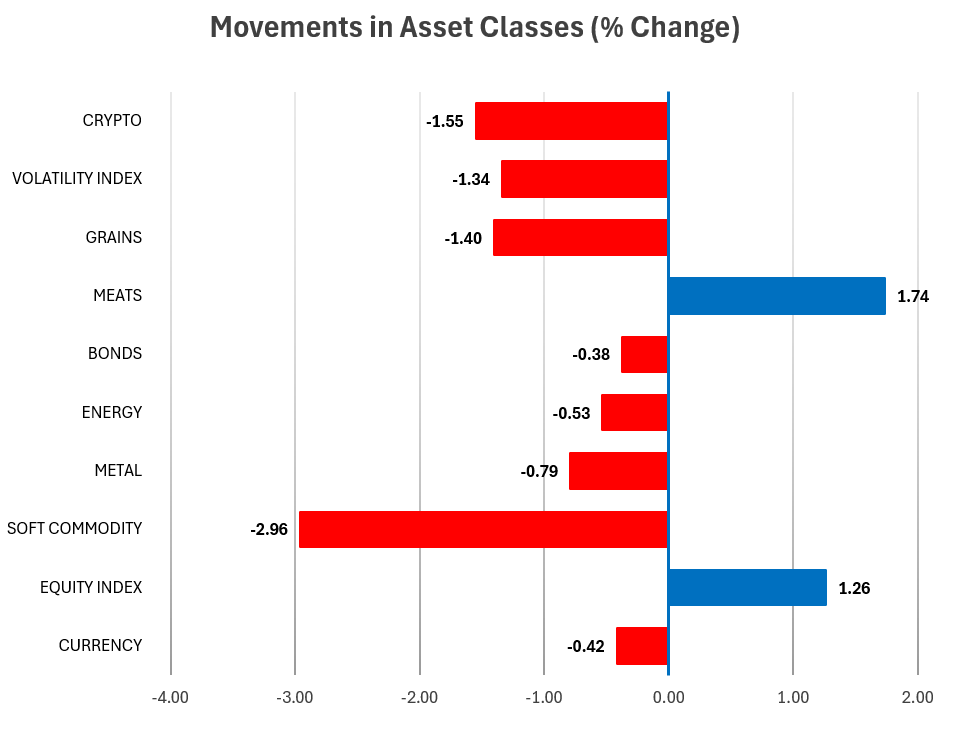

Weekly Asset Class Snapshot

Source: Finwiz.com

Asset Class Breakdown – Uneven Glimmers

- Meats: +1.74% – Feeder cattle (+2.96%) and live cattle (+1.68%) extended leadership.

- Equity Indices: +1.26% – Nasdaq (+2.09%), Russell 2000 (+2.27%), and S&P (+0.39%) lifted global equities, though Nikkei fell (−1.19%).

- Metals: −0.79% – Gold (+1.12%) and silver (+2.96%) provided ballast, but palladium collapsed (−6.17%).

- Soft Commodities: −2.96% – Coffee (−7.95%) and cocoa (−2.71%) dominated sector weakness.

- Crypto: −1.55% – Bitcoin retraced from highs.

- Grains: −1.40% – Soybeans, canola, and soybean oil pulled lower, offsetting corn’s small gain.

- Energy: −0.53% – Crude and nat gas eased, stuck in range.

- Bonds: −0.38% – Yields ticked higher, led by weakness at the long end.

- Currencies: −0.42% – USD firmed modestly, while AUD and NZD lagged.

- Volatility Index: −1.34% – VIX steady at subdued levels.

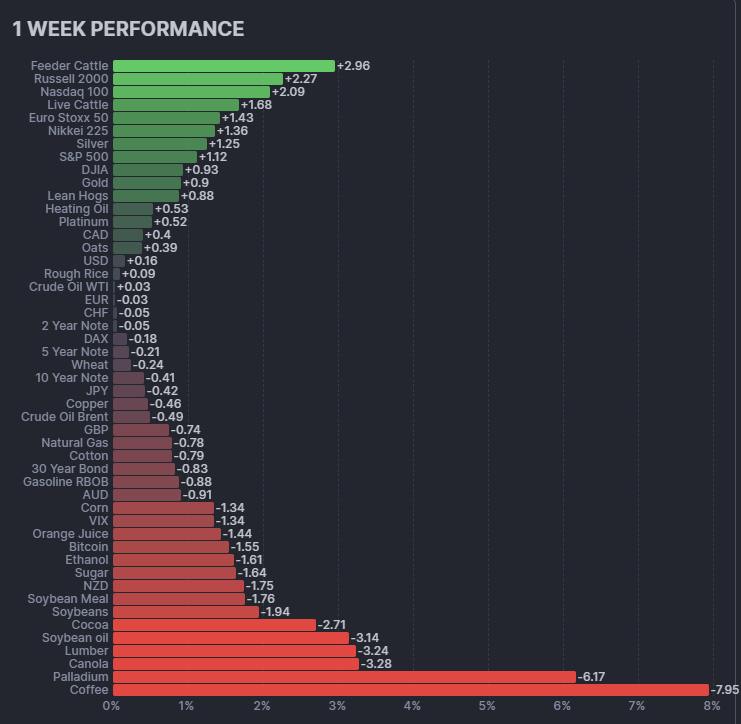

Performance Highlights – This Week’s Market Leaders & Laggards

Top Market Movers

Top Gainers

- Feeder Cattle: +2.96% – Fresh sector leadership.

- Russell 2000: +2.27% – Small-cap strength boosted equity breadth.

- Nasdaq 100: +2.09% – Tech resilience intact.

- Silver: +2.96% – Strongest among metals.

- Live Cattle: +1.68% – Added to meat sector gains.

Top Losers

- Coffee: −7.95% – Steepest commodity reversal.

- Palladium: −6.17% – Outlier collapse.

- Canola: −3.28% – Weakness persisted in grains.

- Lumber: −3.24% – Ongoing drag in softs.

- Soybean Oil: −3.14% – Rounded out heavy softs declines.

Portfolio View - Positioning and Impact

- Equities: US markets pushed higher, supporting composite strength. Japan softened, trimming Asian contribution.

- Meats: Outlier gains in cattle offset broader commodity weakness.

- Metals: Silver and gold provided steady support, while palladium’s collapse dented the sector's balance.

- Softs: Coffee’s dramatic reversal weighed heavily, dragging the asset class lower.

- Grains: Soy complex remained under pressure, diluting corn’s mild gains.

- Crypto: Bitcoin’s setback reduced its diversifier contribution.

- Energy: Range-bound crude and gas kept exposures muted.

- Rates & FX: Bonds softened at the long end; FX was mixed, with the USD firmer and commodity currencies weak.

Final Reflections – Coming Home Strong

This week underscored the precarious balance in global trends. Equities and meats offered narrow beams of resilience, but collapsing softs and palladium showed how quickly setbacks can tilt the balance.

The SG Trend Index still reflects recovery underway, but the TTU Barometer’s slide back into weak territory highlights fragile breadth. For systematic trend followers, the lesson is clear: resilience in isolated corners is not enough. True compounding requires breadth — and for now, the heavy weights remain in control.

List of Resources used in the Week in Review

Important Disclaimers

This document is directly solely to Accredited Investors, Qualified Eligible Participants, Qualified Clients and Qualified Purchasers. No investment decision should be made until prospective investors have read the detailed information in the fund offering documents of any manager mentioned in this document. This document is furnished on a confidential basis only for the use of the recipient and only for discussion purposes and is subject to amendment This document is neither advice nor a recommendation to enter into any transaction. This document is not an offer to buy or sell, nor a solicitation of an offer to buy or sell, any security or other financial instrument. This presentation is based on information obtained from sources that TopTradersUnplugged (“TTU”) (“considers to be reliable however, TTU makes no representation as to, and accepts no responsibility or liability for, the accuracy or completeness of the information. TTU has not independently verified third party manager or benchmark information, does not represent it as accurate, true or complete, makes no warranty, express or implied regarding it and shall not be liable for any losses, damages, costs or expenses relating to its adequacy, accuracy, truth, completeness or use.

All projections, valuations, and statistical analyses are provided to assist the recipient in the evaluation of the matters described herein. Such projections, valuations and analyses may be based on subjective assessments and assumptions and may use one among many alternative methodologies that produce different results accordingly, such projections, valuations and statistical analyses should not be viewed as facts and should not be relied upon as an accurate prediction of future events. There is no guarantee that any targeted performance will be achieved Commodity trading involves substantial risk of loss and may not be suitable for everyone

TTU is not and does not purport to be an advisor as to legal, taxation, accounting, financial or regulatory matters in any jurisdiction. The recipient should independently evaluate and judge the matters referred to herein. TTU does not provide advice or recommendations regarding an investor’s decision to allocate to funds or accounts managed by any manager (“or to maintain or sell investments in funds or accounts managed by any manager, and no fiduciary relationship under ERISA is created by the investor investing in funds or accounts managed by any manager, or through any communication between TTU and the investor

In reviewing this document, it should be understood that the past performance results of any asset class, or any investment or trading program set forth herein, are not necessarily indicative of any future results that may be achieved in connection with any transaction. Any persons subscribing for an investment must be able to bear the risks involved and must meet the suitability requirements relating to such investment. Some or all alternative investment programs discussed herein may not be suitable for certain investors This document is directed only to persons having professional experience in matters relating to investments. Any investment or investment activity to which this document relates is available only to such investment professionals. Persons who do not have professional experience in matters relating to investments should not rely upon this document.

This document and its contents are proprietary information of TTU and may not be reproduced or otherwise disseminated in whole or in part without TTU’s prior written consent.

This document contains simulated or hypothetical performance results that have certain inherent limitations AND SHOULD BE VIEWED FOR ILLUSTRATIVE PURPOSES. Unlike the results shown in an actual performance record, these results do not represent actual trading. HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR INVESTMENT ACCOUNT.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM OR OTHER ASSET.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. No representation is being made that any investment will or is likely to achieve profits or losses similar to those being shown.

Most Comprehensive Guide to the Best Investment Books of All Time

Most Comprehensive Guide to the Best Investment Books of All Time

Get the most comprehensive guide to over 600 of the BEST investment books, with insights, and learn from some of the wisest and most accomplished investors in the world. A collection of MUST READ books carefully selected for you. Get it now absolutely FREE!

Get Your FREE Guide HERE!