New Highs on Wall Street did not Spoil the Momentum for Trend Followers…

Headlines during April in the Financial Media were mixed to say the least when it comes to CTA's and Hedgefunds…

PROFIT & LOSS:

“CTAs: feeling the Heat”

AXIOS:

“The Hedge Fund Moment is Over”

Bloomberg:

“Hedge Funds Keep Failing to Deliver on What They’re Selling”

“AQR Sees Reprieve Coming for Trend-Following Funds”

I like the last one of course.

At least it's based on a detailed study by people who actually do quant trading for a living.

What the media did not focus on so much…is the failing of the stock and bond markets to “survive” without artificial life support.

As equities surge to all-time highs, volatility has all but vanished. Investors are betting the calm will last, shorting the CBOE Volatility Index, or VIX, at rates not seen in at least 15 years.

Large speculators, mostly hedge funds, were net short about 175,000 VIX futures contracts in late April, the largest such position on record, according to weekly CFTC data that dates back to 2004.

It is almost as if investors have forgotten the past 6 months roller-coaster ride as well as the FEDs U-turn. According to various sources that I follow, the backdrop of this U-Turn as the western stock markets were sliding into their Christmas Eve bloodbath, was the Chinese economy hitting a 30year slowdown, which put the Peoples Bank of China into high gear, releasing somewhere between $800bn to $1T worth of stimulus in a 3 month period, which in perspective is about 4 times what the FED did at the peak of QE infinity. This flood of liquidity resulted in a surge in the Chinese stock market that led the rest of the world to follow suite.

On top of this liquidity driven rally we had the Powell pivot, which may not have been about saving the US equity markets directly, but rather the US fixed income markets. Allow me to share a few more views I picked up from what I believe are credible sources.

If we go back to Halloween time last year, two downgrades of GE bonds by the rating agencies was enough to shift GE bonds from Investment Grade to Junk territory. This led to a deep-freeze in the primary issuance market in the junk bond market…and for 41 days, no new bonds were issued. International organizations raised their concern that the US could be heading into a credit crisis, which would be much worse than an equity crisis. The U-turn by Powell that followed unfroze the issuance market in US bond market…all of a sudden CFOs were once again able to continue to do share buy-backs and Q1 2019, is in fact hitting record amounts of share buybacks.

Today, US corporate debt is about $9.5T and consists of increasingly low quality debt, where even in the investment grade portion, app. half is “pre-junk”, i.e. just above junk status, in addition to the $1.2T actual junk and another $1.2T levered loans with no covenants. So more than half of it is really vulnerable to any increase in rates. And we may well find out who can withstand an increase in rates because we've got almost $800 billion of that debt rolling this year and another $900 billion next year.

Allow me to finish with one final observation I picked up and which originates from the fourth quarter numbers for S&P earnings. The top 20% of companies accounted for 75% of the earnings. That's in the S&P 500. Those are the largest 500 companies! And when you look at cash positions, it's even more profound. The top 20% have 80% of the cash. In fact, if you add up the cash of the top three companies in the S&P, the biggest cash holders, they have more cash than the bottom 450 companies. Just three companies! So perhaps FED Chair Powell, was looking at the corporate sector and its “ability” to service all of this debt, when he did his U-Turn? Because, really, outside those top 20%, there is little ability to service any increase in debt service.

I only mention the above, to illustrate that we live in highly unusual financial times, and to stress the importance of having exposure to un-correlated strategies, such as trend following, within a portfolio.

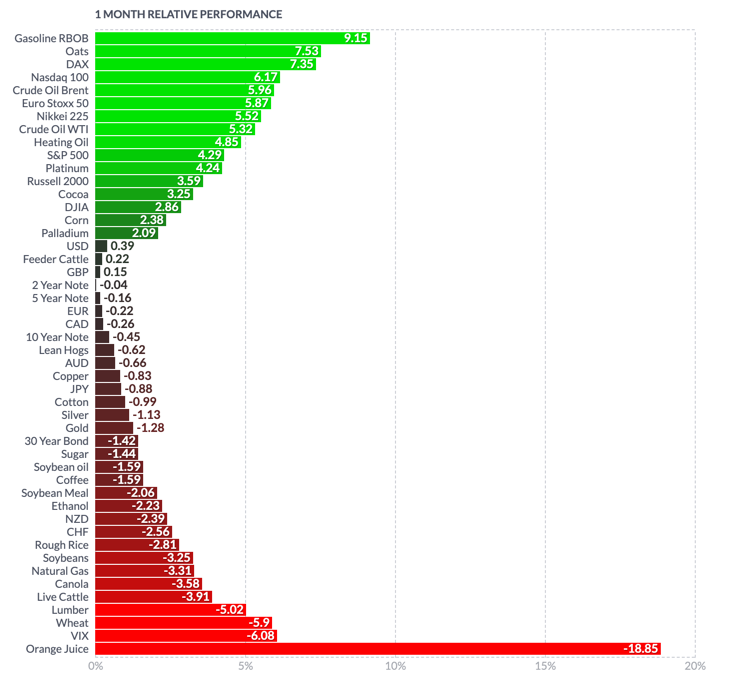

Market moves this month:

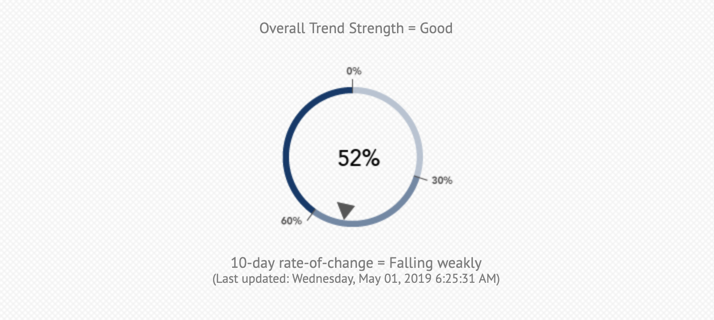

Trend Barometer statistic this month

The Trend Barometer finished a month at a bullish level of 52, which supports early indications from the CTA performance data that is being released as I write this update.

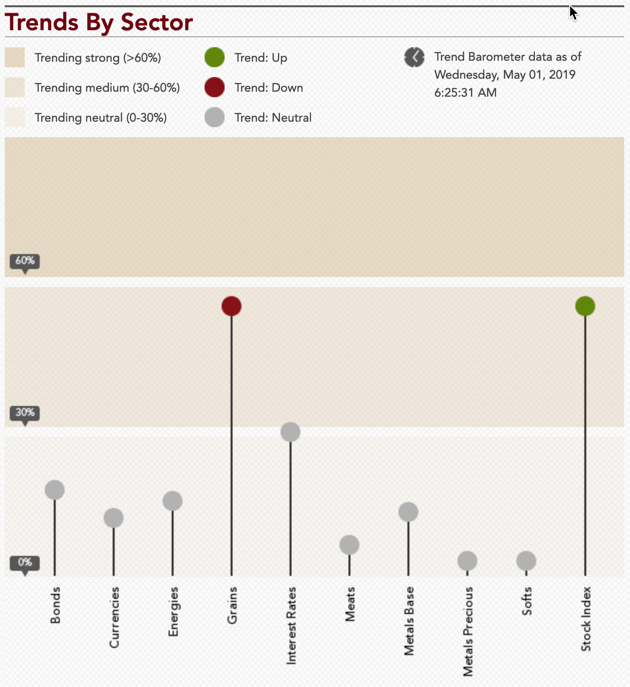

The next chart below shows a snapshot of a 44-market portfolio with markets listed in “groups” of market sectors:

The number of markets recorded in a trending state at the end of the month was 17…up from 16 , but once we include those ending right at the neutral reading (indicated by the “grey” shade right at the 30% level) we get up to 24, which puts the Trend Barometer in “positive” teritory. Please note that for the individual markets a reading of 30 is considered neutral as opposed to the Trend Barometer itself, where this level is 45.

We saw a clear divide between RED dots (down trends) in Commodities mostly, Grains in particular as well as a couple of Currencies (strong Dollar)…whilst Equities, saw mostly GREEN (up trends) joined by a couple of Energy markets at the end of the month.

In the chart below, I have grouped the markets into 10 sectors. Since last month, the number of sectors exhibiting an overall trending state decreased from 3 to 2 out of 10 sectors… , with one ending at a neutral level, which is still a really low number of trending sectors.

Not surprising it was Equities (up trending) and Grains (down trending) that were the sectors showing consistent trends at the end of the month, in line with the individual market trends. In fact Grains have been one of the better trending sectors this year.

After a strong month of March to wrap up a solid Q1, it was nice to see the trend following industry, not only hold on to these gains, but expand upon them.

And regardless of how many articles that continues to suggest the failing or even death of trend following, I bet that when you read this blog in 5 years or more…the industry will still be around, perhaps thriving more than ever, as we see common sense catch up with traditional bond and stock markets.

And speaking of common sense…as my guest this weekend on The Systematic Investor Series put it:

“Trend following…I love it…and I know it works and its based deeply in human nature.”

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS

I hope you found the information useful as part of your own evaluation of the trend following part of your investment portfolio. I will continue to do my best to keep you up-to-date with regards to the environment for diversified trend following strategies and would love to discuss any of this information with you. Just reach out to me.

P.S. if you want to follow the Trend Barometer on a daily basis, please click here and if you want to see the list of Market Symbols explanations, please click here.