Strong Trend Performance…Even Without a Crisis!

US Stocks had their strongest June since 1955 and recorded their highest ever monthly close, leaving investors in the S&P500 17% better off than at the end of 2018, marking the best first half in more than two decades.

Fears for the economy have stoked government bonds as investors fret slowing growth and rock-bottom inflation. Treasuries returned just over 5% in the first half as they piled in. In the process more of the yield curve inverted, and the world’s pool of negative yielding debt swelled to a new record.

Yet as bonds screamed recession, stocks defied that, too.

This continued fairy tail for equity investors, authored by policy makers, has in recent years not been too kind to the trend following community, much to the delight of the part of the financial media who love to call for the extinction of this strategy. I distinctly remember one such headline from Bloomberg on February 28…

One of Wall Street’s Most Popular Trading Strategies Is Now Failing

and the article went on to say…“Turns out the algorithms behind so-called trend-following quants are rather primitive and suffer from many of the same weaknesses a mortal brain might. They've struggled to react fast enough to the unforeseen side effects of ending a decade of central bank stimulus, and even seem to get baffled by U.S. President Donald Trump.”

Well, luckily for those of us who have had a long love-affair with trend following, we know not to pay attention to the financial media.

…and so the story goes that despite Donald Trump's continued tweets, a trade war of proportions we have not seen in decades, injection of liquidity that frankly was unimaginable not long ago, trend followers had a pretty good first half of 2019 too. Who would have thought that this little loved strategy, that is often referred to as a “Crisis Alpha” tool, could deliver such strong results without a Crisis. Of course you knew this…as did I.

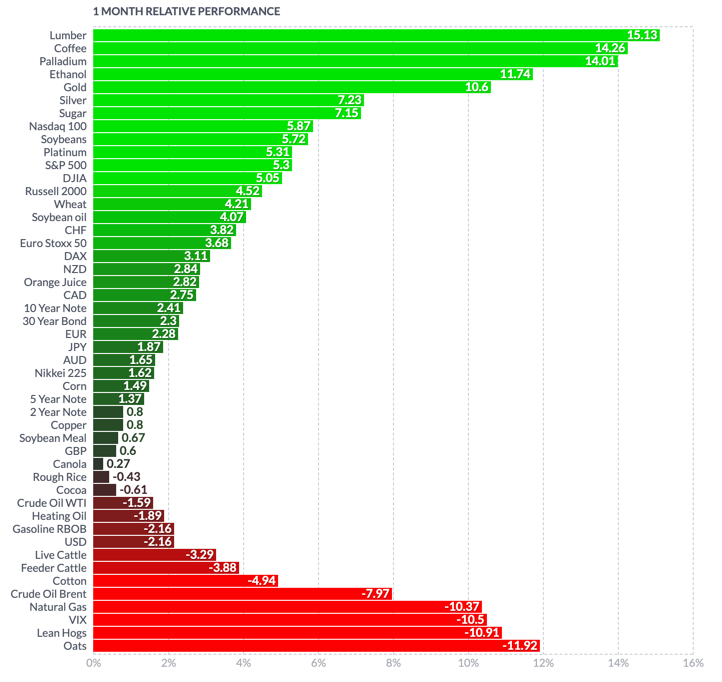

Market moves this month:

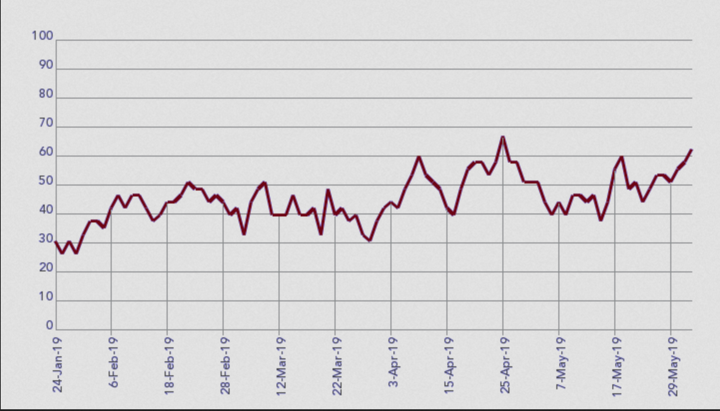

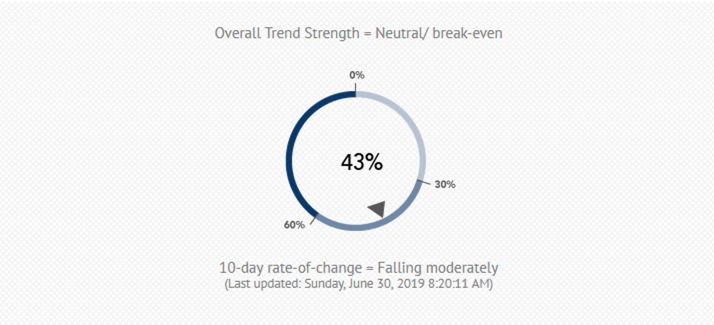

Trend Barometer statistic this month

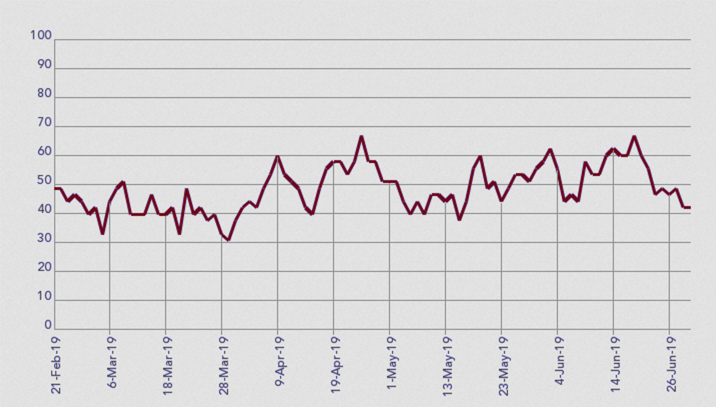

The Trend Barometer finished the month at a neutral level of 43, which normally would suggest a quiet/flat month for most CTAs and Trend Followers in particular. But that is not what early indications are suggesting.

The reason for this, is that a lot of the month was in fact spent at higher levels for the Trend Barometer, which peaked around 68 mid-month. So the foundation for a solid month and a solid first half was in place, even if the last few days of June have been a bit more challenging.

BUT not all trend followers did equally well in the first six months of 2019 and the return dispersion between seemingly similar trend followers is quite high. As individual manager returns for June are not published by the time of this post, looking at the end of May returns, I noticed a huge range in the trend following returns for the first five months, between -19% to +15% – which goes to show that not all trend followers are the same.

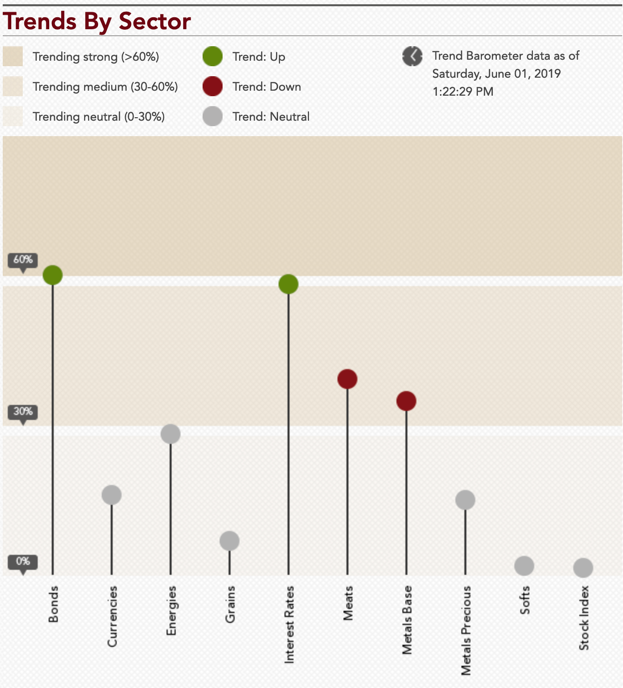

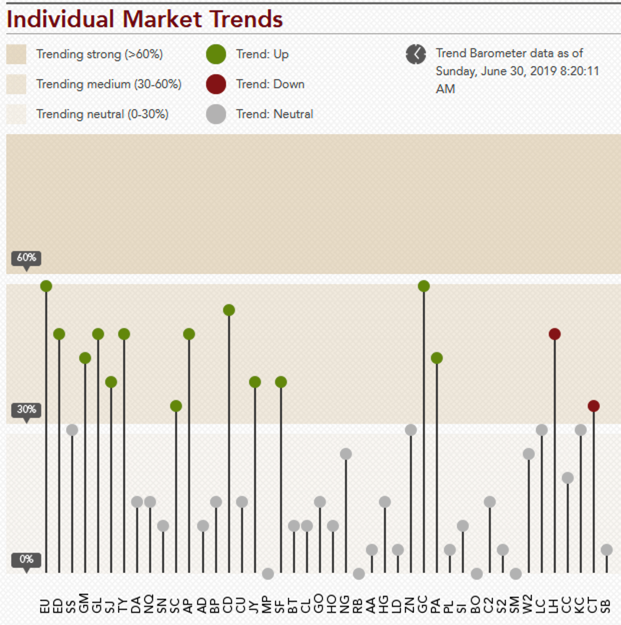

The next chart below shows a snapshot of a 44-market portfolio with markets listed in “groups” of market sectors:

The number of markets recorded in a trending state at the end of the month was 15…down from 21 , but once we include those ending right at the neutral reading (indicated by the “grey” shade right at the 30% level) we get up to 19, which puts the Trend Barometer in a “neutral” territory. Please note that for the individual markets a reading of 30 is considered neutral as opposed to the Trend Barometer itself, where this level is 45.

In the RED camp (down trends) this months, we only find two markets namely Lean Hogs and Coffee. Carrying the GREEN flag (up trends) at the end of the month we see lots of Fixed Income markets, a couple of Stock Indices & Currencies (against the US Dollar) as well as Gold and Palladium.

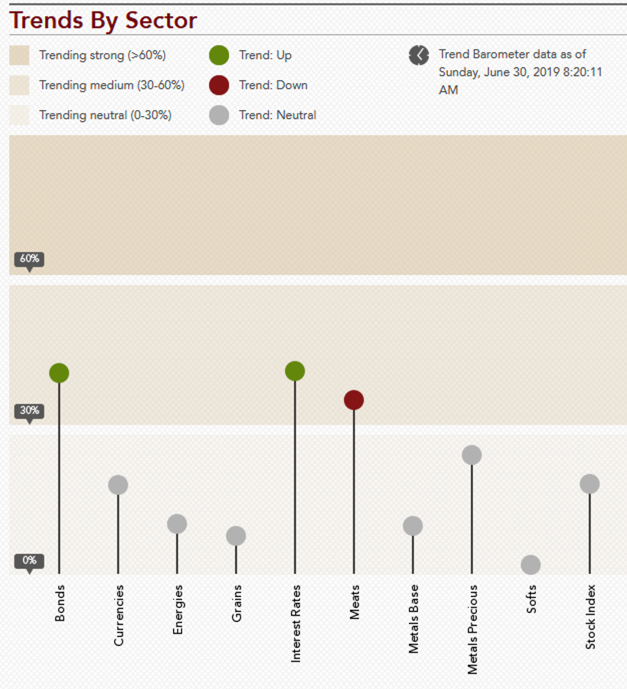

In the chart below, I have grouped the markets into 10 sectors. Since last month, the number of sectors exhibiting an overall trending eased back from 4 to 3 out of 10 sectors. Still not super strong, but enough to finish the month on a positive note, especially because the fixed income sectors hold a good number of markets in them.

Like last month, it was short-term Interest Rates and long-term Bonds (up trending) and Meats (down trending) that were the sectors showing consistent trends at the end of the month.

From the lows of the current drawdown for most established trend following managers at the end of November 2018, we have had 5 out of 7 positive months in the BTOP50 index, which has been a nice change. As much as I expect the recovery to continue and the industry to make new all-time highs again, we should not be surprised (or disappointed) when we see a bit more choppiness return to the performance of trend followers. As much as we must manage our negative emotions during drawdowns, we must also manage our joy when smooth returns have persisted for some time, as it has never been how this strategy behaves in the long run. BUT, this is not a forecast of difficult times ahead…just a quick reality check and a reminder that Buffet was right when he said “Be fearful when others are greedy and greedy when others are fearful”, and we need to continue to learn to love the drawdowns of trend following as much as the run-ups in performance, as true wealth in this strategy is built (like in most investment strategies) by being a long term investor.

Let me finish with a quote I received from George, a loyal listener and a great help to the podcast;

“Most investors miss the point of having a strategy with rules. It's not to find a magical method that works all the time. It's about operating within a certain framework so you know what to expect good and bad and how to respond. It's about establishing a circle of competence.” – Mark Minervini

And if you want to check in on the state of trend following, join me each weekend on The Systematic Investor Series, where we give you a raw and honest account of what it's like to be a rules based investor and share with you which trends are happening right now.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS

I hope you found the information useful as part of your own evaluation of the trend following part of your investment portfolio. I will continue to do my best to keep you up-to-date with regards to the environment for diversified trend following strategies and would love to discuss any of this information with you. Just reach out to me.

P.S. if you want to follow the Trend Barometer on a daily basis, please click here and if you want to see the list of Market Symbols explanations, please click here.