Risk-On is back…and dealing with a few myths…

Each year lots of pundits like to remind/scare investors about the historic negative events that sometimes occur during the month of October…especially the 1987 crash. And like all humans, investors fear the risk of loss much greater then then joy of gain…so this narrative always seem to do the trick.

But it strikes me that things have changed this year, as I see more and more commentators and non trend following managers play this card on a regular basis.

“Trend Followers have failed on their mandate to deliver Crisis Alpha…”

is what I'm hearing (followed by a marketing statement about a strategy being offered that is able to make money in periods like February and Q4 2018).

hmmm…

I wonder why they say this…I'm sure I don't need to spell this out to you!

But here is the deal. Trend Followers do not design their strategies with “a mandate to deliver Crisis Alpha” in mind…but rather to deliver strong long-term absolute returns.

This so-called “mandate” is made up by those who want to portray trend following in a negative light. It's a mirage…it doesn't exist.

Oh…and by the way…the term “Crisis Alpha”, did not exists until 2011…decades after the established trend followers designed their strategies.

Of course, some shorter-term managers may design their strategies to deliver performance during short term corrections in stock markets…and if they can…all power to them. But let's not kid ourselves…there is a cost to the long term performance in doing so. But that's fine, as long as investors is made aware of this…and we as trend followers should not point fingers at them for doing so.

What is somewhat ironic about the increased focus on the risk of a major crash or down-turn in stock market prices in recent years, is that it is taken place whilst stocks continue to make new all-time highs. Instead of worrying about what is not happening, we should be focusing and celebrating what is happening in the markets and ensure that we have as much exposure to those trends.

This brings me to another criticism that I'm hearing. Namely that Trend Followers have become too dependent on Fixed Income markets in order to make money.

Again, I would respectfully disagree with this statement. In fact, I would go so far to say, that anyone who did not make a lot of money in Fixed Income in the last decade or two, was not serving their clients well. It is our job as rules based investors to have concentrated exposure to a sector if that is the best sector to be in.

Having “conviction” based on the data presented is what trend following is all about.

Making lots of money in a few markets, in order to pay for the many small losses is how the strategy has always worked…so why would it be any different now?

As Dr. Daniel Crosby notes in his book The Behavioral Investor;

“Good” investment strategies have to be empirically supported, theoretically sound and behaviorally rooted”

three criteria that Trend Following meets.

But just like with another such strategy, namely Value investing, you can read every academic journal article and biography of Warren Buffett that has ever been written, and still find it stomach churningly difficult at times to stay invested in these styles of investing. But the data and evidence don't lie.

The founding fathers of Trend Following, decided to play the odds and ditch the story. Perhaps not the smartest way to build a large asset base, but probably the best way to serve the investors.

Market moves this month:

Trend Barometer statistic this month

The Trend Barometer finished the month at a low reading of just 27, suggesting a negative environment for trend following strategies and this is confirmed by the early performance numbers from the main CTA indices. And to make things even more difficult, the Trend Barometer reached it's lowest level of just 9 during the month of October…a level that I have not seen since starting to publish the daily Trend Barometer in 2015.

The current transition in the markets from Risk-Off earlier in the year to Risk-On is causing the challenge as the models have to re-adjust to changes in underlying market momentum.

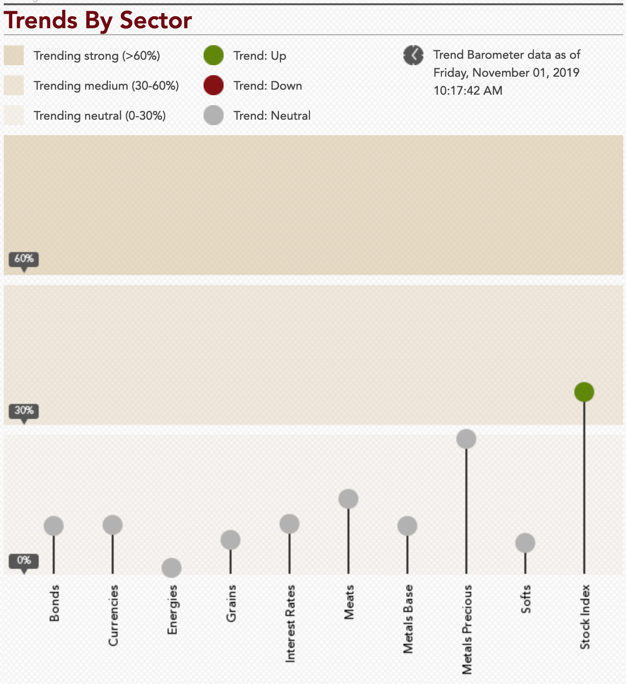

The next chart below shows a snapshot of a 44-market portfolio with markets listed in “groups” of market sectors:

The number of markets recorded in a trending state at the end of the month rose to 10…up from 7 in the previous month, and even if we include those ending right at the neutral reading (indicated by the “grey” shade right at the 30% level) we only get up to 12, which continues to put the Trend Barometer in weak territory. Please note that for the individual markets a reading of 30 is considered neutral as opposed to the Trend Barometer itself, where this level is 45.

In the RED camp (down trends) this months, we only see the German BOBL. Carrying the GREEN flag (up trends) at the end of the month we see stocks well represented along with the Mexican Peso, a couple of Metals, Bean Oil and Live Cattle.

In the chart below, I have grouped the markets into 10 sectors. Since last month, the number of sectors exhibiting an overall trending state rose from 0 to 1 out of 10 sectors. Another piece of evidence that shows the transition that many markets find themselves in at the moment.

The general low level of trending sectors we have seen in the last few years, is supported by a detailed analysis published by the good people at Abbey Capital, which analyzes the CTA performance in the past 3 decades.

As you know, whenever trend followers are in a drawdown, which by default happens often (despite it being a profitable strategy), commentators are quick to point out why trend following is “dead” and must (in their opinion) have stopped working.

In recent times there seem to be a few favorite reasons mentioned as to why this must be the case. 1) “Too much money in the space”, 2) “Trendfollowers are being front-run or gamed by other market participants” and 3) “Markets have become faster and Trendfollowers are too slow to react”.

But in an excellent paper by Abbey Capital these arguments are robustly proven to be misplaced and not founded upon facts. In fact, they elegantly show that when you look at the Trend Following industry, the AuM on a volatility adjusted basis has hardly grown in the past decade, unlike the underlying futures markets where growth have been significant… to say the least.

Perhaps the financial commentators are confused with the growth in the assets managed by Hedge Funds. According to Wall Street Journal, there were just 530 hedge funds in 1990, managing a total of $39 billion. Today there are more than 8,200 all trying to find winning bets for what is now a vast trove of $3.2 trillion of investor money. But oddly enough, the growth in Hedge Funds is never cited as a problem.

Abbey Capital concludes that the most compelling explanation is that the market environment has been characterized by fewer major moves and fewer sustained multi-month trends than in previous decades, something I personally whole heatedly agree with and which I have observed in my own Trend Barometer.

Why there have been fewer major trends in markets, is more difficult to address with certainty. Perhaps the success of the Central Banks to (for now) disallowing recessions, but at the same time failing to deliver periods of strong growth is the simple explanation. When we don't have large fluctuations in GDP, maybe trends across all sectors are harder to come by?

But just because you have a decade long period with lower returns for Trend Followers, which by the way could also be by design to meet institutional appetite for low vol return streams, it does not mean that you won't have higher returns in the future. And let's not forget that equity markets have gone through the same fluctuations in returns. The list below provides a sobering look at how poor real returns in US Equities can be over even long periods of time and how regular such occurrences truly are.

Real growth of one dollar

1929 – 1943: $1.08

1944 – 1964: $10.83

1965 – 1981: $0.94

1982 – 1999: $11.90

2000 – 2010: $0.91

With a change of the “Largarde” at the ECB, continued uncertainty in the US-China trade relations, an upcoming Christmas election in the UK…this current decade still has the potential of throwing up some more surprises, so lets see what the last two months have in store for us.

We know from the academic world that we feel the pain of Loss twice as much as the joy of Gain…but perhaps as a surprise to some, Regret is even worse. With Regret, we are looking back, second guessing our decision. The emotions around that decision don’t fade, because it continues to reside in our present state of mind. I hope investors around the world will take action now to avoid regretting later not having any or too little exposure to trend.

If you want to check the current state of trend following, join me each weekend on The Systematic Investor Series, where we give you a raw and honest account of what it's like to be a rules based investor and share with you which trends are happening right now.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS

I hope you found the information useful as part of your own evaluation of the trend following part of your investment portfolio. I will continue to do my best to keep you up-to-date with regards to the environment for diversified trend following strategies and would love to discuss any of this information with you. Just reach out to me.

P.S. if you want to follow the Trend Barometer on a daily basis, please click here and if you want to see the list of Market Symbols explanations, please click here.