- Richard Tomlinson, CIO of LPPI, shares why pension funds are shifting toward endowment-style portfolios to balance today’s payouts with tomorrow’s promises.

- His insights underscore the increasing importance of real assets, liquidity discipline, and avoiding unnecessary complexity in portfolio construction.

- The lessons extend beyond pensions. Individual investors can also think long-term, diversify wisely, and prepare for a potentially bumpy market decade ahead.

When people think of pension funds, they might picture stodgy institutions buried in bonds and actuarial tables. But as Richard Tomlinson, Chief Investment Officer at Local Pensions Partnership Investments (LPPI) in the UK, explains, an evolution is underway. LPPI manages around £26 billion in assets, and Richard has spent decades across hedge funds, multi-asset investing, and consulting before taking on his current role.

According to Richard, the largest pools of retirement capital are being run less like traditional pensions and more like university endowments. The reason is that the promises these funds have made extend decades into the future. They must pay today’s retirees while building capital that can endure for generations. That dual mandate forces a different perspective, one that prioritizes compounding, resilience, and liquidity in ways that individual investors can learn from.

Why Bonds May No Longer Be the Default

For decades, bonds anchored pension portfolios. Their predictability offered comfort, and falling interest rates rewarded the strategy. But the world has changed as persistent fiscal deficits, shifting demographics, and geopolitical strain have created an environment where inflation is more likely to average 3 percent than 2. Central banks may wish otherwise, but the forces of fiscal dominance suggest governments will lean on monetary policy to keep borrowing affordable.

In such a setting, bonds no longer guarantee stability. They may still provide ballast in extreme moments, but they carry the risk of long periods of real wealth erosion. Endowment-style thinking begins with that recognition. Instead of assuming bonds will save the day, it asks: What else can provide income, diversification, and protection against inflation?

The Endowment Model for Pension Funds

Universities like Yale pioneered a diversified approach that emphasized equities, private markets, and real assets. The logic was clear: growth assets, even with higher volatility, offer the best chance of compounding wealth over decades.

Pension funds adopting this mindset tilt away from fixed income and toward a mix that resembles endowment portfolios. That means:

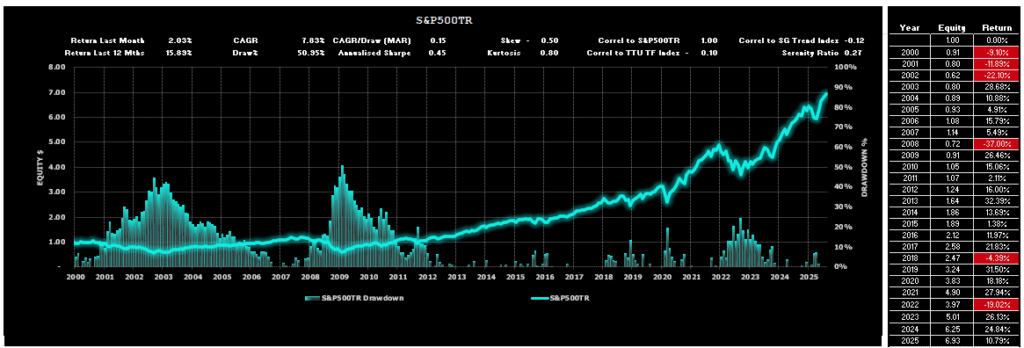

- Equities: Still the core engine of growth, particularly quality companies with durable cash flows.

- Real assets: Infrastructure, real estate, and private credit that provide inflation-linked returns.

- Private markets: Used selectively, not as a magic source of excess return, but as a way to access exposures unavailable in public markets.

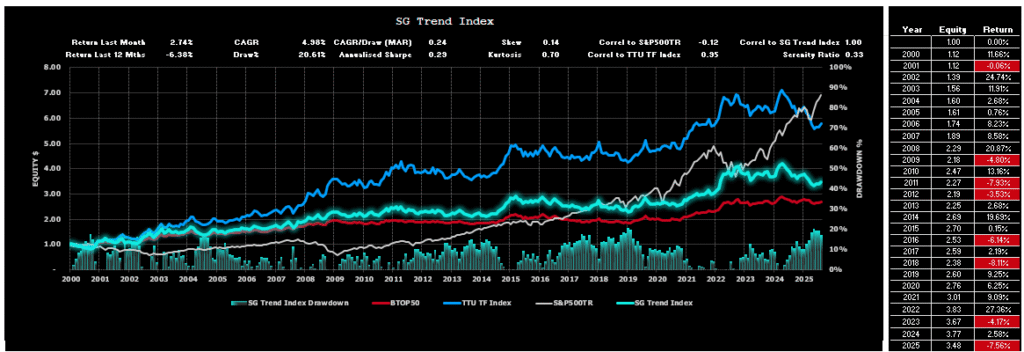

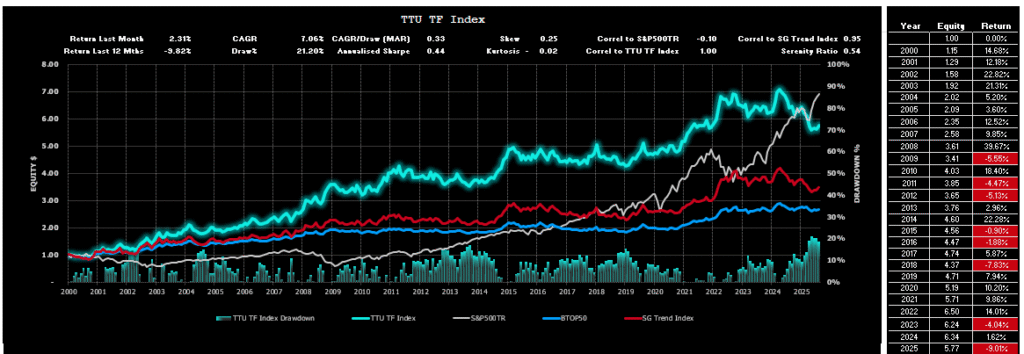

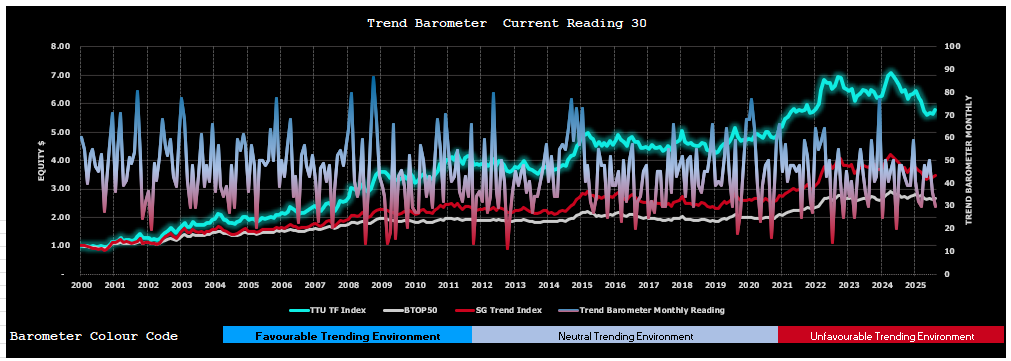

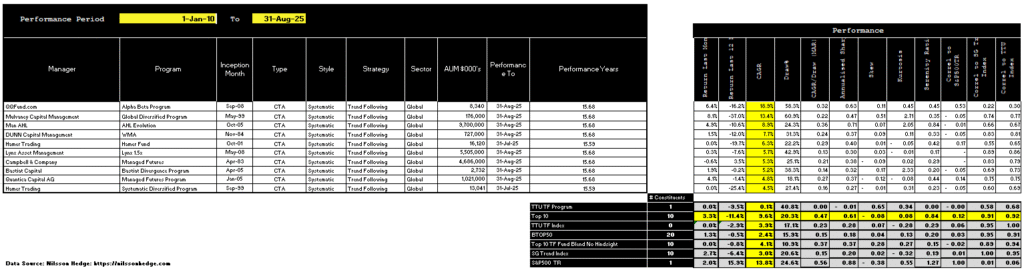

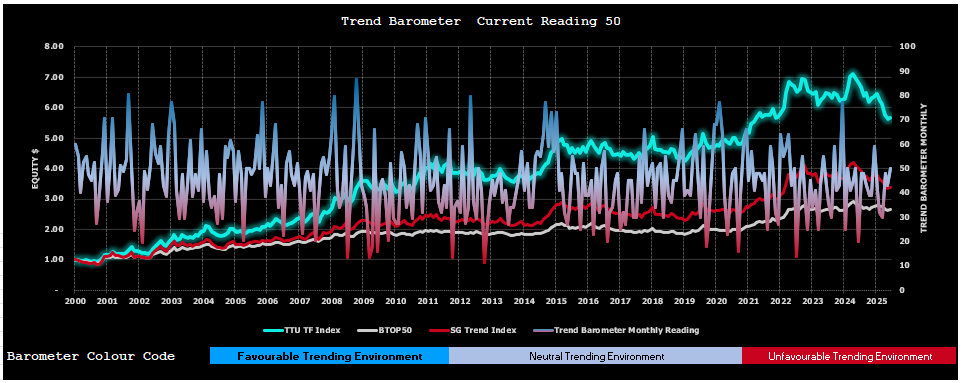

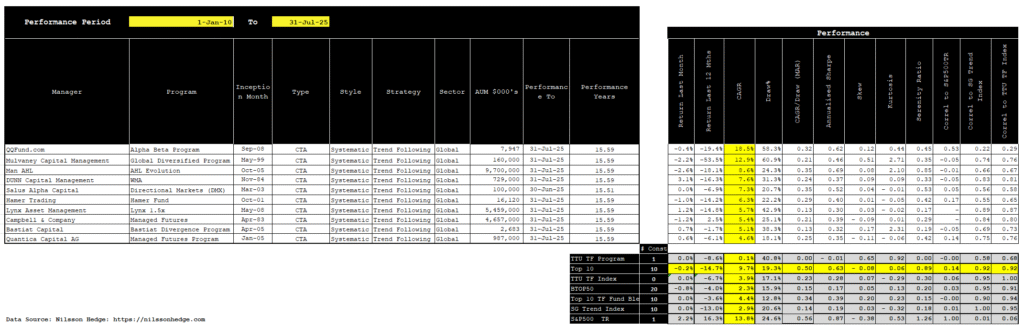

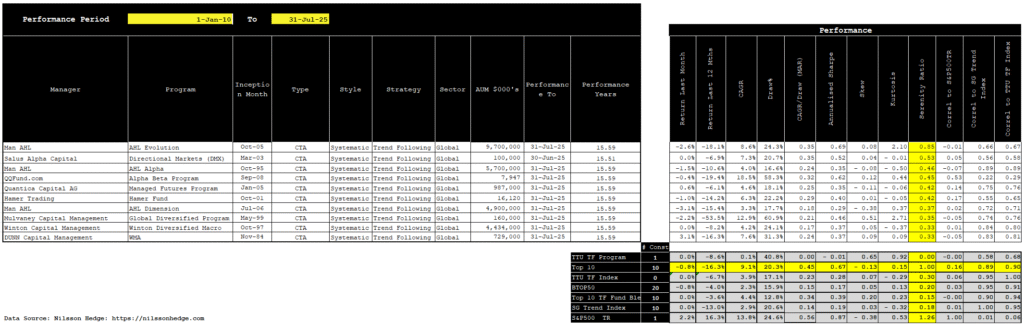

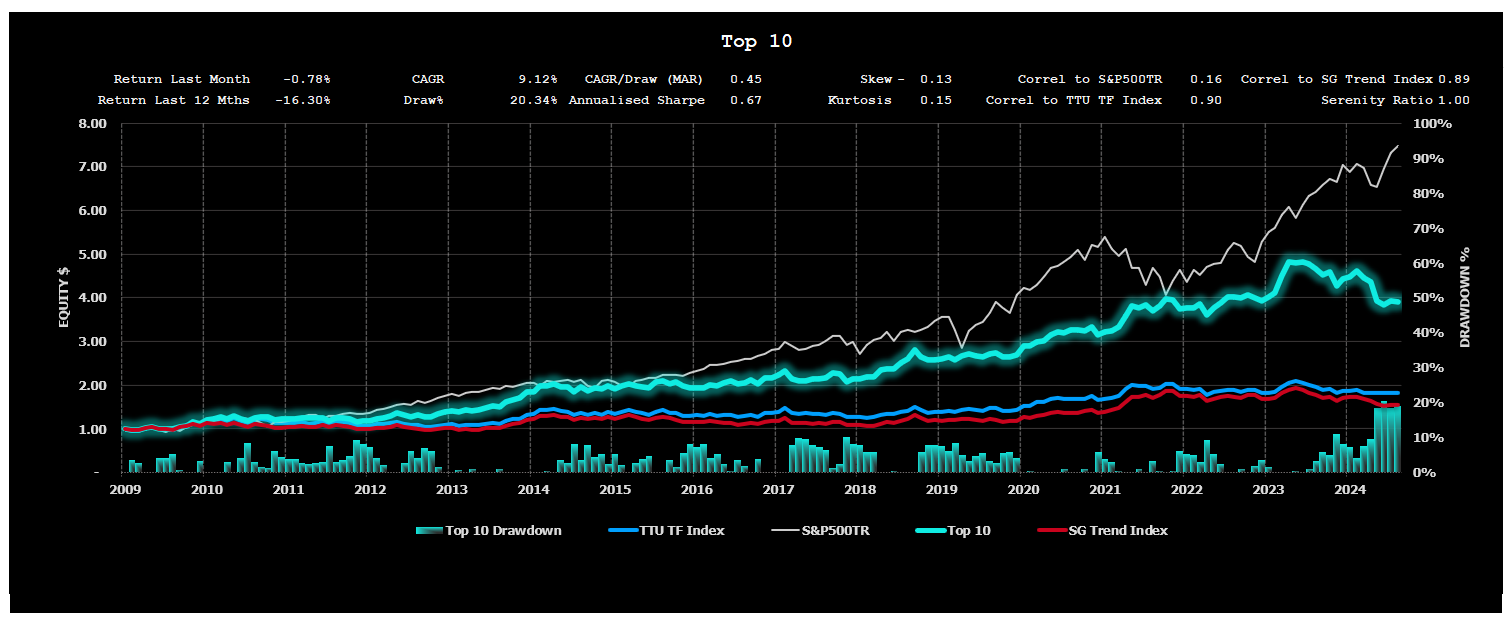

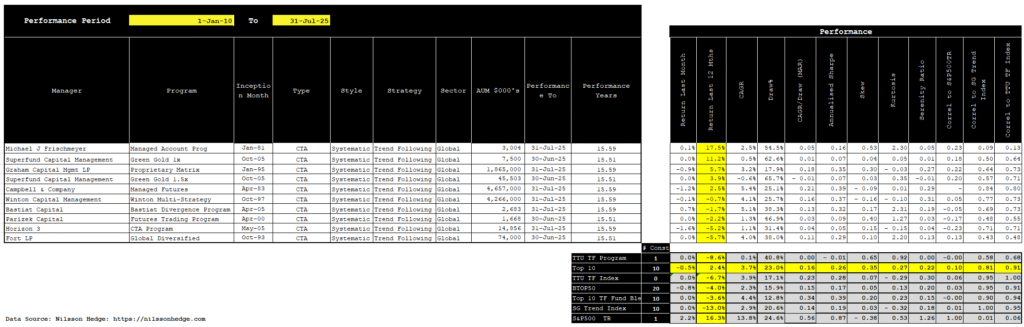

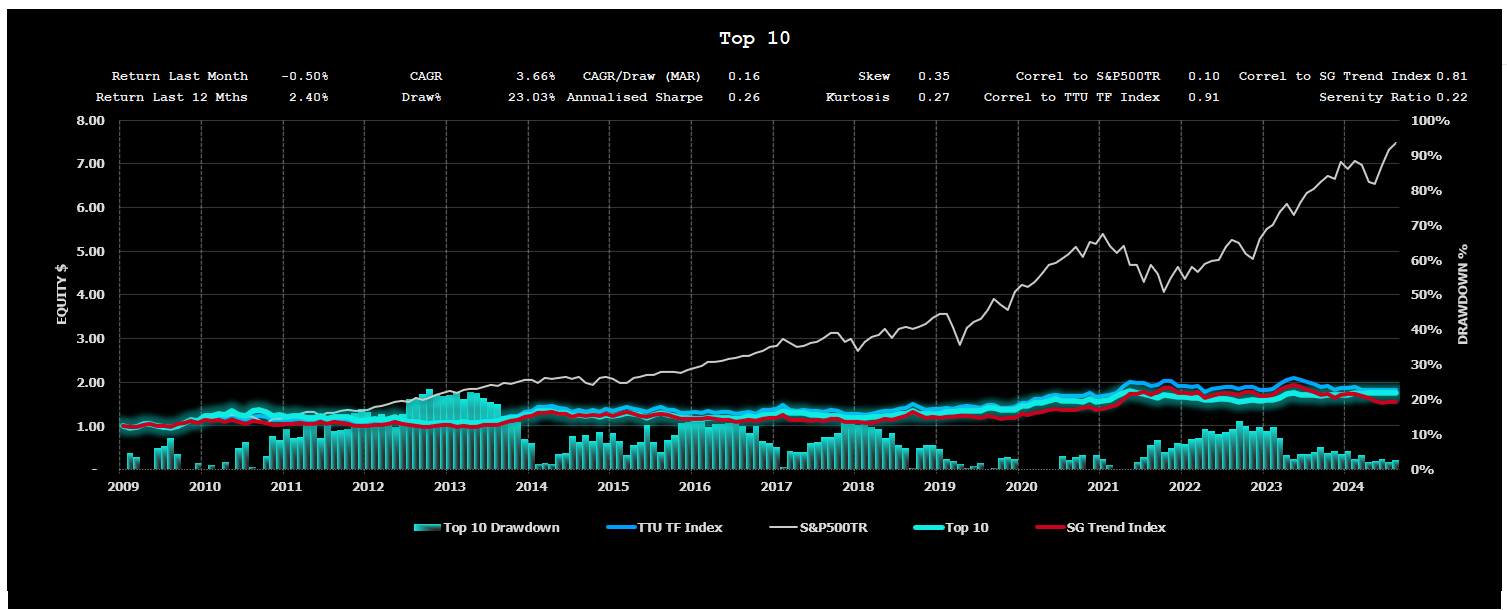

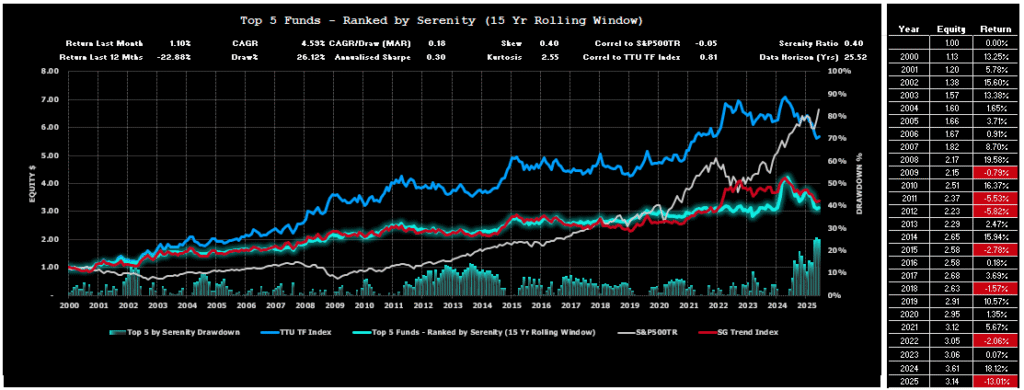

- Alternatives and hedge funds: Trend-following or global macro strategies that can perform when everything else falls.

Sophistication Without Excess

Investing has a habit of confusing complexity with intelligence. Many investors, including pension fund managers, face constant temptation to over-engineer portfolios. The real skill lies in balance: sophisticated enough to do the job, but not so complex that risk becomes unmanageable.

That balance shows up in process. Strong governance, disciplined due diligence, and thoughtful portfolio construction matter more than clever models. A pension fund that overpays for hedge funds or fills its portfolio with opaque structures is not being sophisticated. It’s adding fragility.

The lesson for individual investors is the same. Resist the lure of products that promise returns without risk. Focus instead on clarity of goals, quality of assets, and the discipline to hold them through cycles.

Liquidity: The Stress Test That Matters

The most dangerous moments for a pension fund aren’t when returns disappoint, but when liquidity disappears. A fund that cannot pay retirees without selling equities down 40 percent has failed, regardless of its long-term strategy.

That is why endowment-style thinking emphasizes liquidity buffers. Some diversification is about more than correlation; it is about cash. Strategies that deliver liquidity during market stress, such as trend-following or macro funds, can be worth their cost if they prevent forced selling elsewhere.

For individual investors, the parallel is obvious. Having reserves to cover expenses in downturns prevents the worst mistake of all: selling quality assets at the bottom. Liquidity is not exciting, but it is survival.

Inflation and the Case for Real Assets

Every generation of investors has to unlearn old assumptions. For those who came of age in the 2010s, low inflation felt permanent. For those managing pensions today, higher inflation feels like the base case.

Real assets including property, infrastructure, and private credit play a critical role in this environment. They are not perfect hedges, but they provide exposure to the real economy in ways bonds cannot. Even equities, while offering growth, can falter if margins erode under persistent cost pressure. Owning assets tied to tangible goods and services adds resilience.

The lesson here is broader: when the future looks different from the past, portfolios must adapt. Clinging to yesterday’s assumptions is comforting, but costly.

The Public vs. Private Debate

Private markets are often sold as the answer to low yields. But the reality is more nuanced. Illiquidity is not always a premium, and investors should be cautious about assuming it always pays.

For pension funds, private markets serve multiple purposes: local development, access to niche opportunities, and diversification. But they are not a cure-all. Returns vary, and fees can erode the benefit. The better approach is to use private markets where they truly add exposure that public markets cannot, not simply as a return booster.

For individuals, the takeaway is similar. Do not chase private investments because they seem exclusive. Ask whether the asset truly offers something unique, and whether the costs justify the risks.

Global Orientation, Local Liabilities

A UK pension fund cannot ignore that its liabilities are linked to domestic inflation. But it also cannot afford to concentrate solely at home. The balance between global diversification and local exposure is delicate.

The broader lesson is that currency and geography matter. Owning global equities diversifies risk, but liabilities are often local. Understanding how different exposures interact with personal obligations, whether mortgages, college tuition, or retirement spending, is essential.

The Governance Edge

One overlooked strength of institutional investors is governance. Pension funds evaluate themselves not only on returns but also on cost savings, risk management, and stewardship. Balanced scorecards weigh financial and non-financial outcomes, a discipline that protects against the tyranny of short-term performance chasing.

Individuals can borrow that mindset. Define success by more than quarterly returns. Consider costs, consistency, and alignment with long-term goals. For many, the best investment decision is the one that allows you to sleep at night, even if it underperforms in the short run.

Lessons Beyond Finance

Perhaps the most valuable lesson comes from careers rather than portfolios. Just as portfolios thrive when the wind is at their back, so do careers. Choosing industries with structural growth makes it easier to succeed. The same principle applies to investing: owning assets aligned with long-term trends allows for mistakes along the way without derailing the outcome.

Integrity matters too. Reputations take a lifetime to build and a moment to lose. That applies to portfolio managers, but also to individuals managing their own financial lives. Discipline and honesty are the compounders of trust.

What It Means for the Next Decade

The last 15 years rewarded investors who relied on declining rates and cheap money. The next 15 may look very different. Higher inflation, geopolitical friction, and fiscal dominance suggest a bumpier path.

But uncertainty is not a reason to retreat. A diversified portfolio of equities, real assets, and carefully chosen alternatives still offer the best odds of compounding wealth over decades. The lesson of endowment-style pension investing is not to avoid risk, but to own it thoughtfully, with enough liquidity and resilience to endure shocks along the way.

For individuals, the message is clear. Think like an endowment. Match assets to long-term goals, prepare for volatility, and remember that compounding is the quiet force that turns today’s decisions into tomorrow’s security.

This is based on an episode of Top Traders Unplugged, a bi-weekly podcast with the most interesting and experienced investors, economists, traders and thought leaders in the world. Sign up for our Newsletter or subscribe on your preferred podcast platform so that you don't miss out on future episodes.