Mark Rzepczynski was my guest in this week’s episode of the Systematic Investor podcast series. Similar to last week’s show, we spent a good chunk of time discussing a research paper recently made public.

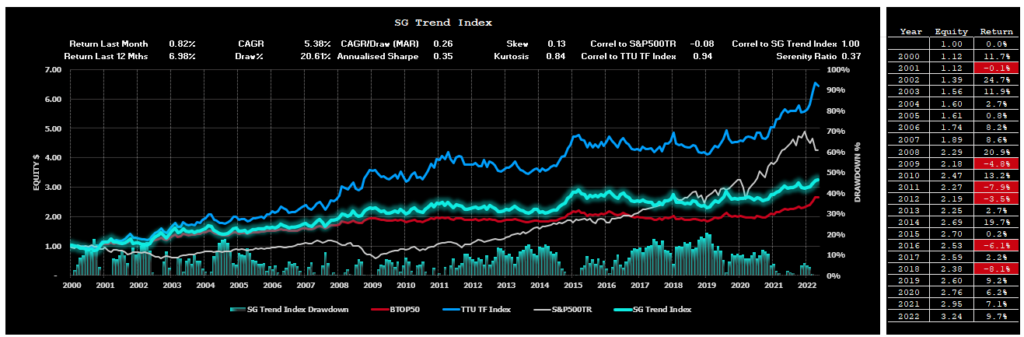

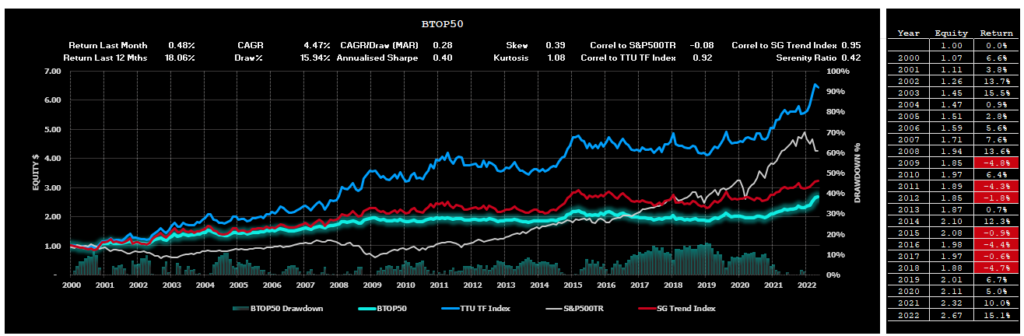

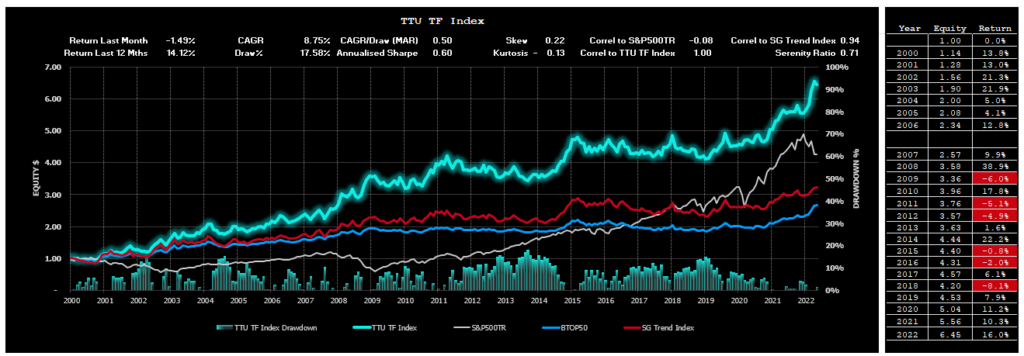

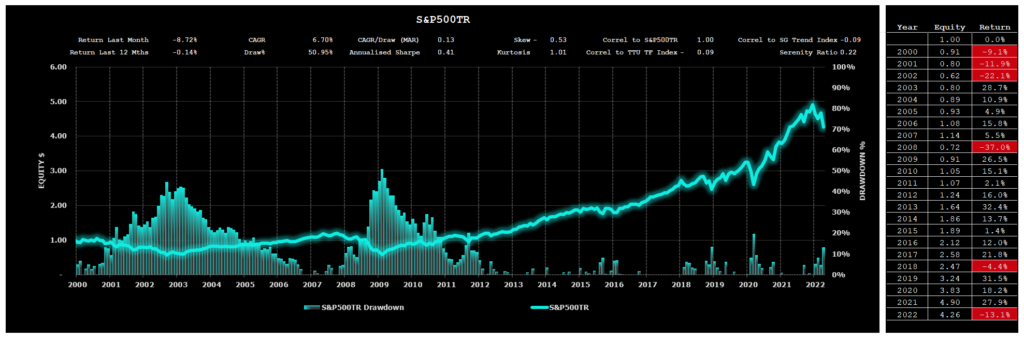

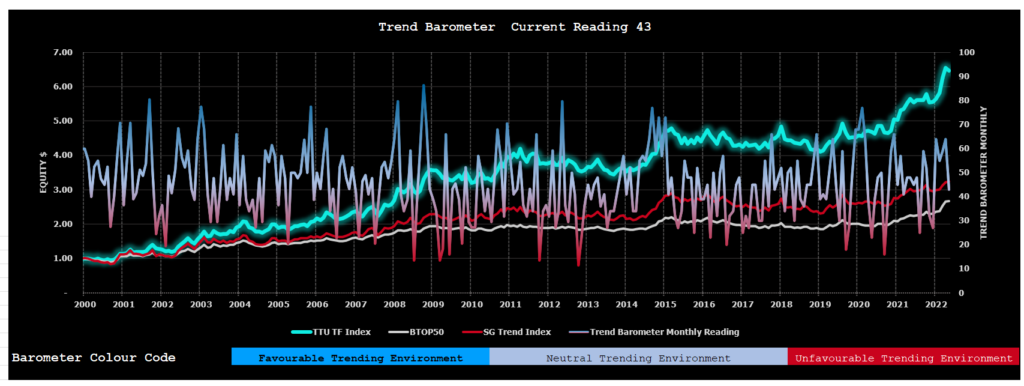

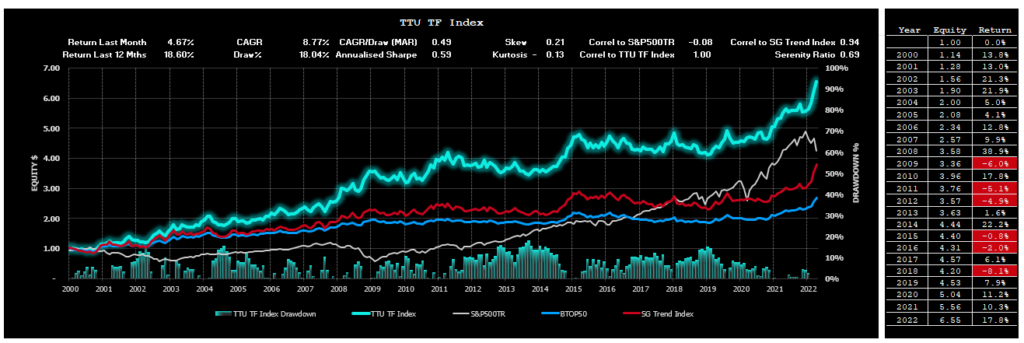

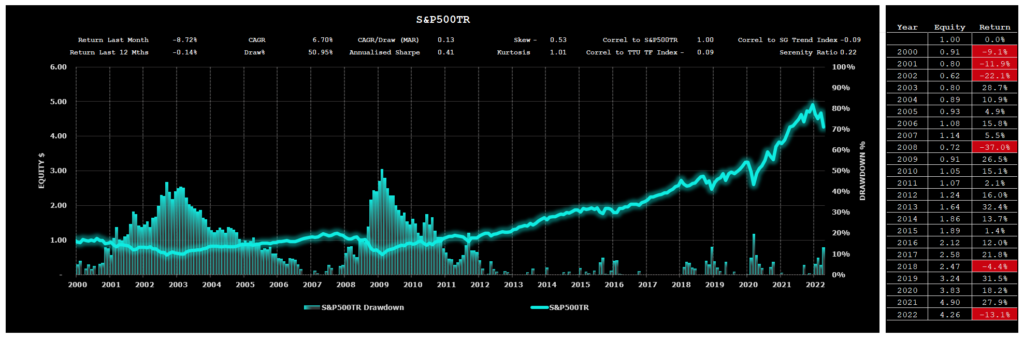

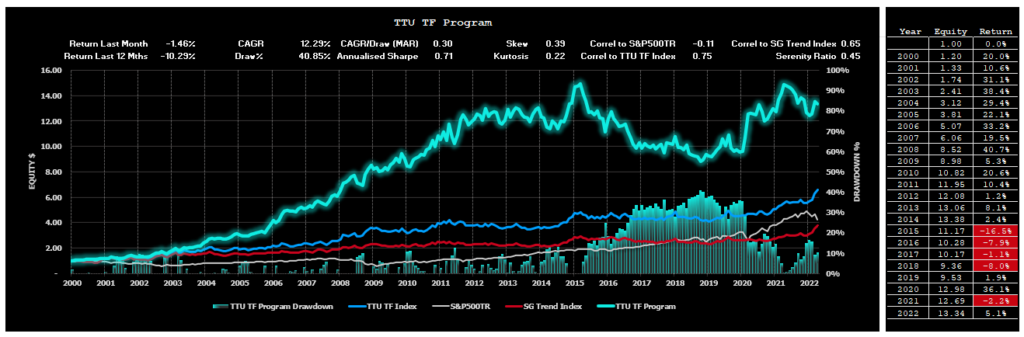

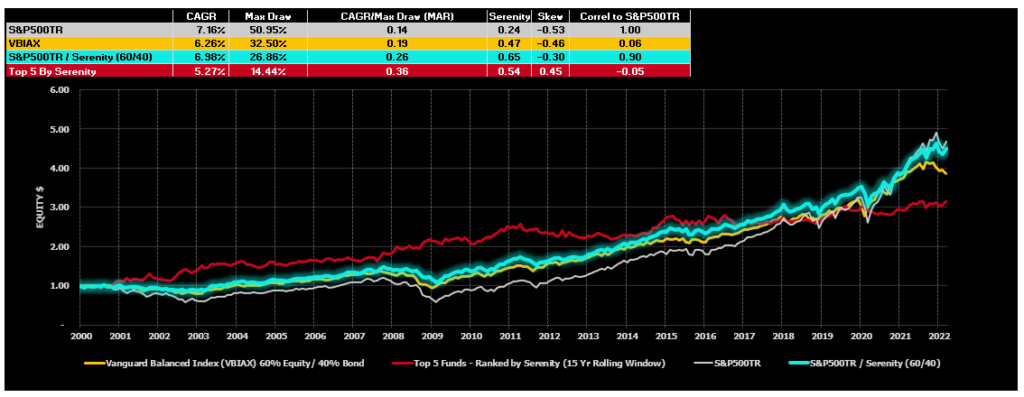

It would be no surprise to our readers and listeners that the research paper we discusses praises Trend Following and strongly advocates for its inclusion in traditional long-only portfolios. According to the study, in the current macroeconomic environment, which Mark coined as the “great repricing of risk”, Trend Following performs well which is a function of its ability to find outliers across a broad opportunity set and take advantage of its flexibility to take long and short positions.

Where the paper falls a little short, was to elaborate on why is the “risk repricing” occurring and why Trend Following is able to take advantage of that. Thankfully, Mark was kind enough to shed some light on this question and share with our listeners his views and theory.

According to Mark, one of the reasons why Trend Following has been so successful in the past few months is the fact that market participants have been slow to recalibrate their expectations and views. This phenomenon is well studied in the field of Behavioral Economics and stems from cognitive errors known as Recency Bias and Anchoring Effect. These biases lead to the formation of long-term trends (like in the current market environment) which Trend Follower are able to beautifully capture.

Another explanation of the recent success of Trend Following offered by Mark can be viewed through the concept of convergence/divergence. As a reminder, convergent markets are mean-reverting; there is a well-established equilibrium that the markets revert to every time a deviation occurs. Divergent markets, on the other hand, occur when there is a fundamental change in the equilibrium price at which people perceive an asset should be valued.

Coincidentally, as inflation is currently runing on multi-decade highs, leading to the above-mentioned “repricing of risk”, we find ourselves in the midst of a divergent market environment where market participants seek to establish a new price equilibrium for risk assets. Therefore, given its “divergent seeking nature”, it should be no surprise that Trend Following is truly thriving in the current market environment, while so many traditional investment strategies have recorded severe losses.

Curious to find out what Mark had to say on this and may other topics? Feel free to tune into this week’s episode of our Systematic Investor podcast series and find out yourself. As usual, we promise your time will be well spent.