- Independence without accountability often drifts into recklessness, whether in policy or investing.

- Anna Wong says the Fed’s challenge is balancing its independence with accountability, a lesson investors can apply to their own decisions.

- The most resilient portfolios come from combining freedom with responsibility and conviction with humility.

When Anna Wong, Bloomberg’s chief U.S. economist, said “Independence cannot exist without accountability” in a recent conversation, she was speaking about the Federal Reserve. But the phrase works just as well as a principle for investing, business, and life.

The Federal Reserve has spent the past few years trying to maintain a delicate balance. If it operates with too much independence, it risks becoming disconnected from the real economy it serves. However, if it becomes too accountable to political pressures, it may lose its credibility as an authority. The balance is fragile, messy, and full of contradictions, which makes it a perfect mirror of how markets work.

Freedom only works with responsibility

Investors crave independence. We want the freedom to call our own shots, design our own portfolios, and ignore the herd. But independence without accountability often leads to ruin. Consider the trader who doubles down on a losing bet in the name of “conviction,” the retiree who ignores spending discipline because they believe “markets always come back,” or the policymaker who cuts interest rates to zero based on weak short-term data.

Independence is powerful, but it must be paired with a sense of responsibility for the outcomes. Without this connection, it can easily slip into recklessness. This principle applies to the Federal Reserve just as it does to individual investors. Freedom and responsibility are not opposing forces; they are interconnected, and the health of one relies on the other.

The illusion of control

Wong has pointed out that tariffs, which are often assumed to be inflationary, have in fact been deflationary. Why? Because the tariffs targeted goods already under pressure from Chinese deflation. Instead of pushing prices higher, they often reinforced downward trends.

This serves as a classic reminder of how little control we have in the market. You can design a policy or an investment strategy with a clear intended outcome, but the second and third-order effects can overwhelm the plan. You can set a tariff to raise prices and ultimately lower them. You can build a portfolio to reduce risk and ultimately concentrate it.

The illusion of control is seductive. Independence makes us feel like we are steering the ship. Accountability forces us to acknowledge how little we actually have control over.

Hidden compounding forces

The stock market itself feeds into inflation mechanically through portfolio management fees, which are tied to the S&P 500. As equities rally, these fees rise, and the result shows up directly in inflation data.

Few think about inflation this way. But that’s the point. In markets, the forces that matter most are often invisible in plain sight. Inflation is not only about wages or energy prices. It’s also about fees, behaviors, and indirect feedback loops.

Compounding works in obvious ways, such as dividends being reinvested. However, it also works in subtle ways, such as rising fees that gradually become part of the cost of living. Independence without accountability blinds us to these feedback loops.

The paradox of progress

AI is another double-edged force. On one hand, it’s pushing younger workers out of the labor force, discouraging new grads from pursuing white-collar jobs. On the other hand, it’s adding meaningfully to GDP growth, driven by a wave of capital investment in data centers and infrastructure.

This is the paradox of progress. What looks like pain in the short term can be the very source of strength in the long term. Technology takes jobs before it creates new ones. Markets fall before they rise. Productivity gains feel like losses to individuals before they show up as growth in the data.

Howard Marks often writes about cycles and Morgan Housel often writes about time horizons. The AI story is both a cycle of disruption that only makes sense when stretched across a long enough timeline. It can stir up panic, but true trends unfold slowly and demand patience to see clearly.

The pendulum of confidence

Consumer sentiment, tariffs, inflation expectations, the Fed’s credibility: They all swing like a pendulum. Extremes tugging on one another often create balance. Powell’s caution versus Waller’s boldness. Independence versus accountability. Hawks versus doves.

Markets need that tension. If one side wins outright, the system tips too far. Progress is forged in the middle ground where opposing forces check each other.

Housing and the limits of safety

Wong’s team built models showing a two-out-of-three chance that U.S. housing prices remain in contraction through year-end, with only modest recovery expected next year. Housing, long considered a safe asset, becomes fragile when unemployment rises and mortgage rates remain elevated.

That, too, is a lesson in independence without accountability. For years, housing was treated as a one-way bet: safe, stable, and always appreciating. But housing depends on incomes, rates, and jobs, all factors beyond a homeowner’s control. Accountability arises when the bill is due and the market does not cooperate.

The broader point: no asset is safe without discipline. Even housing requires humility.

Fiscal dominance and the investor’s trap

There’s also the idea of fiscal dominance, the idea that high debt eventually forces monetary policy to serve fiscal needs. Tariffs, controversial as they are, generate revenue and help stabilize the government’s balance sheet.

Investors face the same trap. Independence makes us want to maximize returns, but accountability comes from the math of compounding. A portfolio that ignores spending, taxes, or drawdowns will eventually be forced into decisions that serve those pressures. Fiscal dominance in government is akin to lifestyle creep in personal finance: you eventually serve the liabilities you have created.

Leadership and culture

Much of the conversation around the Fed today centers on who might lead it under a new administration: Kevin Hassett, Chris Waller, Kevin Warsh. Some believe that once inside the Fed, even politically connected figures often get subsumed by the culture. Independence is constrained by the institution itself.

That echoes a point about investing organizations. A new CIO may arrive with bold ideas, but the culture of risk management, client accountability, and institutional inertia will shape their choices. Independence is always bound by the norms of the system you enter.

A personal takeaway

The Fed’s dilemma is not unique to monetary policy. It’s the same dilemma we face in our own financial lives. We all want independence. We want the freedom to retire early, to say yes to opportunities, and to invest in ways that align with our own convictions. But independence without accountability is a mirage. It’s leverage without risk controls, spending without budgets, conviction without humility.

The best investors and leaders find the balance. They claim independence, but they bind themselves with accountability, whether to a process, to long-term goals, or to the people who depend on them.

The irony is that accountability does not weaken independence. It protects it. The Fed’s independence only has meaning if it remains accountable to outcomes and reality. An investor’s independence only lasts if it is tethered to responsibility for risk.

The bigger picture

Wong said she believes AI could finally lift the economy out of its low-productivity rut, while tariffs, controversial as they are, could at least stabilize fiscal dynamics. That optimism rests not on perfect independence, but on the constant tug-of-war between extremes.

Independence without accountability is dangerous. Accountability without independence is paralyzing. But together they create balance, and balance, in markets and in life, is the closest thing we have to stability.

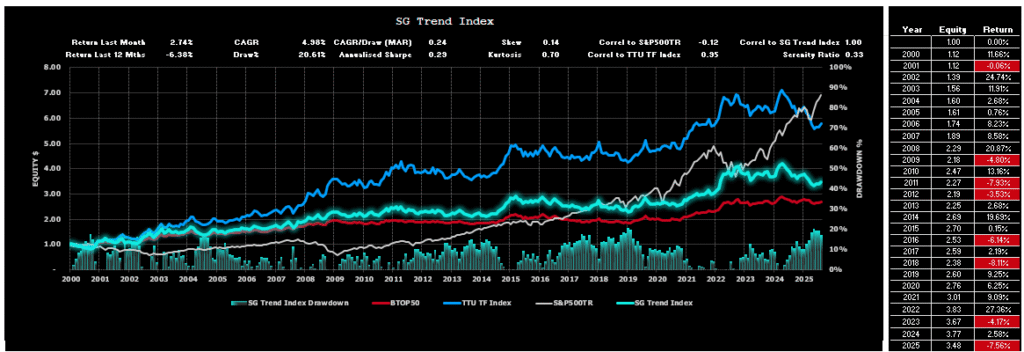

This is based on an episode of Top Traders Unplugged, a bi-weekly podcast with the most interesting and experienced investors, economists, traders and thought leaders in the world. Sign up for our Newsletter or subscribe on your preferred podcast platform so that you don't miss out on future episodes.